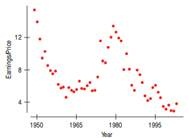

Earnings/price ratio:

Investors often judge the value of a stock by considering the company s earnings (after taxes) relative to the stock price. If the ratio is high, then the stock may be a good buy. Here's a scatterplot of the one stock s earnings/price ratio since 1950:

Clearly, the relationship is not linear. Can it be made nearly linear with a re-expression? If so, which one would you suggest? If not, why not?