You are considering the purchase of one of two large presses. The key financial characteristics of the existing press and the two proposed presses are summarised below.

Old press: Originally purchased three years ago at an installed cost of $400 000, it is being depreciated under prime cost (straight-line) using a 10-year recovery period. The old press has a remaining economic life of five years. It can be sold today to net $420 000 before taxes

Press A:

This highly automated press can be purchased for $830 000 and will require $40 000 in installation costs. It will be depreciated under prime cost (straight-line) using a five-year recovery period. At the end of the five years, the machine could be sold to net $400 000 before taxes. If this machine is acquired, it is anticipated that the following current account changes would result.

Cash +$25400

Accounts receivable + 120 000

Inventories -20000

Accounts payable + 35 000

Press B: This press is not as sophisticated as press A. It costs $640 000 and requires $20 000 in installation costs. It will be depreciated under prime cost (straight-line) using a five-year recovery period. At the end of five years, it can be sold to net $330 000 before taxes. Acquisition of this press will have no effect on the firm's net working capital investment.

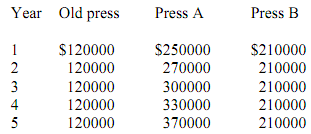

The firm estimates that its earnings before depreciation and taxes with the old press and with press A or press B for each of the five years would be as shown in Table 1.

The firm is subject to a 33 per cent tax rate on both ordinary income and capital gains. The firm's cost of capital, k, applicable to the proposed replacement is 14 per cent.

EARNINGS BEFORE DEPRECIATION AND TAXES COMPANY'S PRESSES

Required

1. For each of the two proposed replacement presses, determine:

a) Initial investment.

b) Net present value.

c) Internal rate of return.

2. Draw NPV profiles for the two replacement presses on the same set of axes, and discuss conflicting rankings of the two presses, if any, resulting from use of NPV and IRR decision techniques.

3. Recommend which, if either, of the presses the firm should acquire