ASSIGNMENT No. 1:

problem 1: Describe the recording, classifying, summarizing and presenting stages of accounting with comprehensive illustration.

problem 2: On August 1 of the current year, Mr. Sohail Amjed established clothing store called Sports Wear. Transactions completed throughout the month were as shown below:

A) Deposited Rs.8000 cash in a bank account for Sport Wear.

B) Purchased equipment for cash Rs.2500

C) Purchased merchandise on account, Rs.2800.

D) Paid salaries and other expenses Rs.400.

E) Sold merchandise on account Rs.1400

F) Purchased merchandise for cash Rs.900

G) Paid cash to the creditors Rs.1900

H) Purchased equipment on account Rs.500

I) Sold merchandise for cash Rs.1800

J) Received cash from customers on account Rs.800

K) Paid salaries and other expenses Rs.300

L) Withdrew cash for personal use Rs.200

M) Returned defective equipment purchased on account RS.100

Required:

• Journalize the above transactions.

• Prepare Trial Balance for the month.

• Prepare Trial Balance.

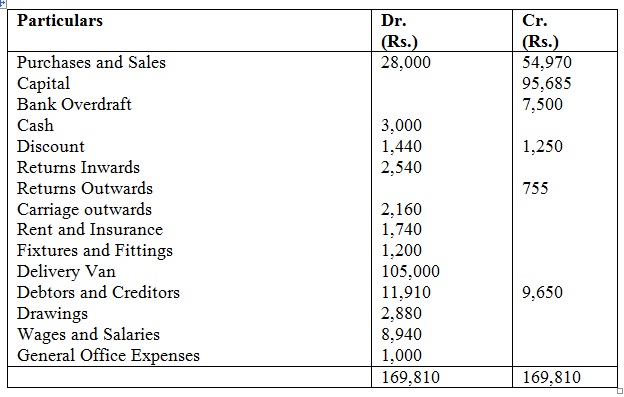

problem 3: Mr Tariq a sole trader extracted the given trial balance from his books of accounts for the year ending on 31st March 2010:

The given adjustments are as well to be made.

a) Stock on 31st March 2010 was Rs. 4,290.

b) Wages and Salaries accrued at 31st March 2010 Rs. 1,580.

c) Office Expenses owing Rs. 580.

d) Rent prepaid 31st March 2010 Rs. 500.

e) Increase the provision for bad and doubtful debts by Rs.810.

f) Depreciation is charged on Fixture & Fittings and Delivery Van at 10%

You are needed to prepare a trading and profit and loss account for the year ended on 31st March, 2010 and balance sheet as on 31st march 2010.

problem 4: What do you understand by merchandise inventory? prepare up a comparative note on perpetual inventory method and periodic inventory method.

problem 5: A firm of manufactures, whose books are closed on 31st December, purchased machinery for Rs.50,000 on 15 January, 2010. Additional Machinery was acquired for Rs.10,000 on 1st July, 2010 and for Rs.16,466 on 14th April, 2012.

Provide the Machinery Account for 5 years writing off depreciation by:

a) Diminishing balance method @ 10% p.a.

b) Straight line method.

ASSIGNMENT No. 2:

problem 1: Expenditures might be divided into two general categories that is, capital expenditures and revenue expenditures.

a) Distinguish between two classes of expenses and their accounting treatment.

b) What criteria do firms generally use in establishing a policy for classifying expenses under these two general categories?

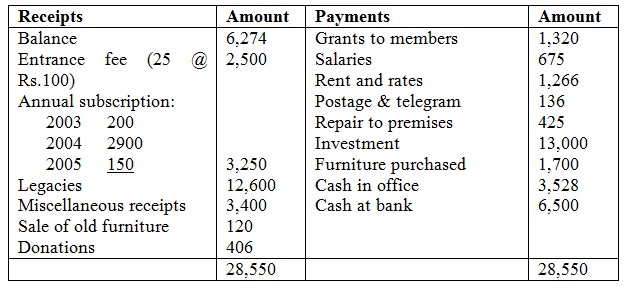

problem 2: The treasurer of a charitable institution has prepared the given Receipts and Payment Account for the period ended on 30th June, 2004.

The given further information is supplied to you.

a) Annual subscription for each member is Rs. 120, Rs. 240 being in arrear for 2003.

b) The rent and rates prepaid to the 31st December 2004.

c) Postage and telegram Rs. 56 related to 2003, still owing Rs. 76. One-half of the legacies are to be treated as income.

d) At 1st July, 2003 the building and premises stood in the books at Rs. 35,000, investment Rs. 12,000 and furniture Rs. 3,000.

e) Depreciation is to be given at the rate of 10% p.a. on furniture and writing down investments by 5% (opening balance only).

You are needed to prepare Income and Expenditure Account for the year ended on 30th June, 2004 and Balance Sheet as on 30th June, 2004

problem 3: On 31st December 2010 the Cash Book of Nadeem Bros., showed a bank balance of Rs.5000/-. This didn’t agree with the pass book balance due to the given:

A) Cheques had been issued for Rs.2500/- out of which cheques worth Rs.2000/- only were presented for payment.

B) Cheques worth Rs.700/- were paid into bank on December 29, however had not been credited by the bank. One cheque for Rs.250/- was entered in the cash book on December 30, however was banked on 3rd January 2011.

C) A cheque from Mujahid for Rs.200/- was paid in on December 26, but was dishonored and memo was received on 3-1-2011.

D) Pass book showed bank charges Rs.10/- debited by the bank. It as well showed Rs.400/- collected by the bank as interest.

E) The debtor deposited a sum of Rs.250/- in the account of the firm on December 20, intimation in the respect was received from the bank on 2nd January 2011.

F) The payment side of the cash book was under cast by Rs.150/-.

G) Dividend amounting to Rs.200/- was received directly by the bank.

Required: Make a Bank Reconciliation Statement as on 31-12-2010

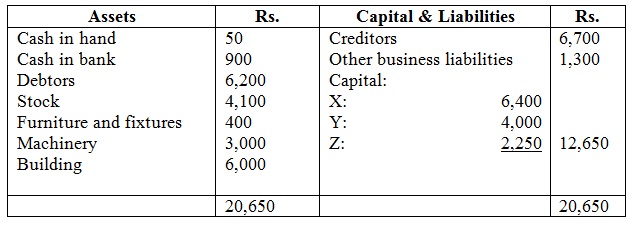

problem 4: The following is the balance sheet of X, Y and Z as on 31st December, 2010. The profit and loss sharing ratio is 3:2:1 correspondingly.

On 31st December, 2010 Y served a notice of retirement on the terms that he will be paid half of the amount in cash at the time of his retirement and the balance as a bill of exchange for three months. Any cash needed is to be taken from the bank. Assets are valued as shown:

a) Goodwill is valued at Rs. 18,000.

b) Furniture and fixture is to be taken by Y at Rs. 300.

c) Machinery is to be depreciated at 10% and building is to be appreciated by Rs.2,000.

d) Stock is adjusted at Rs. 3,700.

e) Capital of the firm should be Rs. 25,000 and the ratio between the remaining partners will be 3:2. Excess or deficit cash is to be paid by the partners.

Required: Pass the essential journal entries and prepare the balance sheet of the new firm.

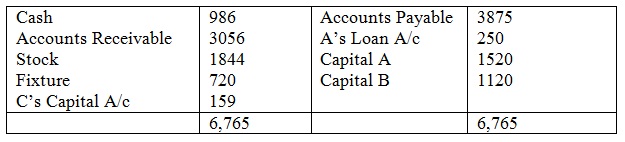

problem 5: A, B and C are in partnership profit and losses sharing ratio of 3:2:1 correspondingly. The state of affairs at the date of dissolution is:

The assets other than cash realized Rs. 4844 and the expenses of winding up are Rs.52 A and B are solvent but C is not capable to bring in anything.

Required: Make the essential adjustments to close the books of the firm by applying the Garner versus Murray Rule.