Section-A

problem 1: prepare short notes on:

a) P V Ratio.

b) Margin of Safety.

c) Material Variances.

d) Absorption Costing.

problem 2: Describe the meaning of the term `variance analysis’. What is its significance in controlling and monitoring costs?

problem 3:

a) What are the pre-requisites of installation of responsibility accounting system?

b) Differentiate between ‘cost centre’ and ‘profit centre’.

problem 4:

a) Differentiate between standard costing and budgetary control.

b) Computation of variances in standard costing is not an end in itself, however a means to an end. Discuss.

Section-B:

Case Study:

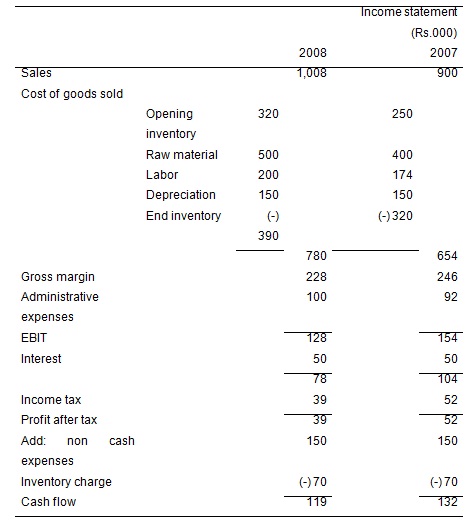

Ramesh developed original specification of a product and founded Ramesh Manufacturing Ltd. In the year 2007 the firm manufactured 980 nos at an average price of Rs.900/- each. In the year 2008 due to continuous price rise of the inputs, he increased his prices at an average of 12%, as he knew he could sell plant’s full capacity of 980 nos per year. In spite of price rise for the product, which sold for over Rs.1000/- for the first time? Ramesh was surprised to learn in late 2008 (as might be seen from the financial statements) that Ramesh Manufacturing Ltd shows a decline in earnings and still worse, decline in cash flow.

His accountant has bought the given:

i) We are following FIFO system for the main purpose of issues.

ii) Costs are going up faster than 12% and they will go up further in the year 2009.

iii) We are not setting aside sufficient to replace the machinery; we require to set aside Rs.1,65,000/- not Rs.1,50,000/- so as to be able to buy new machinery.

iv) It is still not late to switch to LIFO for 2008. This will decrease closing inventory to Rs.3,30,000/- and increase cost of goods sold

Required:

a) Determine the weighted average inflation factor for the firm using LIFO?

b) If the firm desires a 15 % profit margin on sales, how much must the firm charge for the product per unit?