Departmental Expense allocations

Before completing this problem, make sure you have read and studied the Department Expense allocation illustration handout and the demo problem handout. It will really help you out on this problem.

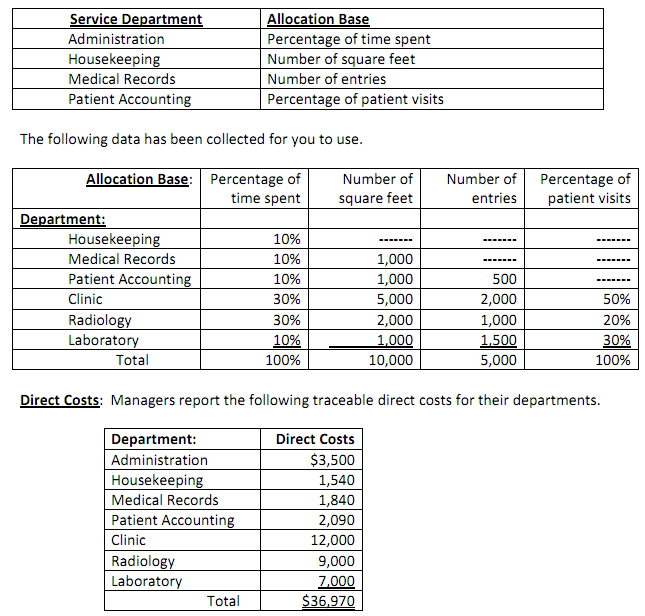

The Live Oak Clinic is a rural health clinic with four service centers and three profit centers. In order of utilization, the service centers are Administration, Housekeeping, Medical Records and Patient Accounting. The three profit centers are Clinic, Radiology, and Laboratory.

Allocation bases for service department costs are:

Indirect Costs: The business incurred indirect costs that benefited for the entire facility totaling $2,000. The costs are to be allocated to the departments in the following ratio: 1:1:1:1:2:2:2. (1 part each for the service departments and 2 parts each for the operating departments for a total of 10 parts)

Instructions

The clinic's administrators have asked you to prepare departmental income statement for the clinic. (See exhibit 21.21 in your book).

1. To complete this task, you must first prepare the cost allocations for the expenses of the service departments to the other service departments and operating departments by completing the cost allocation spreadsheet on the answer sheet.

- I have included supporting schedules for you to use to compute the allocation of service department expenses. When allocating the service department costs, start with the administration costs - those costs are allocated to all the other departments.

Calculate new total costs for housekeeping then allocate those housekeeping costs to the remaining departments (not administration) etc.

- When you have successfully completed the allocations, only the 3 operating departments should have costs - the service departments' costs should have been totally allocated. Keep this in mind: you don't allocate costs to yourself. In other words, no particular service department costs will be allocated back to that department.

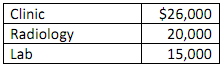

2. Services provided and billed to patients for each of the departments were:

- Prepare the departmental Income Statement for Live Oak Clinic for the month ended March 31, 2011. (Think about this before you totally copy Exhibit 21.21. That exhibit is for a store that sells merchandise. This problem is for a health clinic that provides services only so there is no "cost of goods sold" reported on the income statement.