problem 1: Simple Interest versus Compound Interest First City Bank pays 7 % simple interest on its savings account balances, whereas Second City Bank pays 7 % interest compounded annually. If you made a $6,000 deposit in each bank, how much more money would you earn from your Second City Bank account at the end of 9 years?

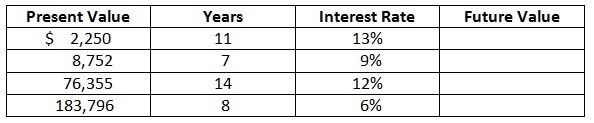

problem 2: Computing Future Values for each of the given, find out the future value:

problem 3: Computing Present Value. You have just received notification that you have won the $1 million first prize in the Centennial Lottery. Though, the prize will be awarded on your 100th birthday (supposing that you are around to collect), 80 years from now. What is the present value of your windfall if the proper discount rate is 9 %?

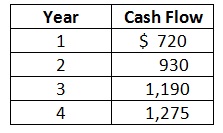

problem 4: Present Value and Mutiple Cash Flows Wainright Co. has identified an investment project with the given cash flows. If the discount rate is 10 %, what is the present value of such cash flows? What is the present value at 18 %? And at 4 %?

problem 5: Computing Present Value An investment will pay you $43,000 in 10 years. If the appropriate discount rate is 7 % compounded daily, then what is the present value?