Computing a linear regression equation to predict the future values of the dependent variable Y.

1. The estimators for the slope parameter and intercept parameter in a simple linear regression model were obtained in class using the method of Least Squares. The resulting estimators turned out to be unbiased. That is  Now, suppose that in order to save some time a careless researcher decides to estimate the slope parameter by connecting the fifth sample point collected (X5, Y5) by a straight line to the thirteenth sample point collected (X13, Y13) and then using the slope of this line to estimate . Suppose we call this estimator *. Is * an unbiased estimator of ? That is, is it true that E [ *] = ?

Now, suppose that in order to save some time a careless researcher decides to estimate the slope parameter by connecting the fifth sample point collected (X5, Y5) by a straight line to the thirteenth sample point collected (X13, Y13) and then using the slope of this line to estimate . Suppose we call this estimator *. Is * an unbiased estimator of ? That is, is it true that E [ *] = ?

1. The estimator is not unbiased and the bias is σ2.

2. The estimator is not unbiased and the bias is the mean square error, MSE.

3. The estimator is not unbiased and the bias is the sample variance of the n-2 points not included in the calculation of the slope.

4. The estimator is unbiased.

5. The estimator is not unbiased, but the bias cannot be obtained in closed form. It depends on where among the scatter plot of points the two points (X5, Y5) and (X13, Y13) happen to lie.

6. It cannot be determined from the information given.

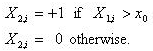

2. Suppose that you wish to use a linear regression to predict the dependent variable Y using the dependent variable X1. You collect a scatter plot of points (X1,i ,Yi) and notice that the plot seems to be well represented by a piecewise continuous linear function that satisfies the following conditions: For X1i≤X0 the appropriate linear model appears to be Yi= α +β1 X1i + ?i. However, whenX1i>X0 the slope of the applicable linear relationship appears to change to β1 + β2.Hint: First, determine the applicable form of the linear model that represents the plot of points (X1,i ,Yi) when X1i>X0 and note that both the slope and Y-intercept of the model will differ from the model applicable to the set of points (X1,i ,Yi) when X1i≤X0. Now see if you can devise a way to combine these two linear relationships into a single multiple regression model by using the indicator variable X2i where

1. There is no way to combine these two linear relationships into a single multiple regression. You should instead run each regression separately as simple regressions.

2. The combined model is: Yi= α + β1X1i + β2X1iX2i + ?i.

3. The combined model is: Yi= α + β1X1i + β2(x0 -X1i)X2i + ?i.

4. The combined model is Yi= α + β1X1i + β2(α - x0 -X1i)X2i + ?i.

5. The combined model is Yi= α + β1X1i + β2(X1i - x0)X2i + ?i.