Compute the net present value of the mold in Example 13.4, assuming that the debt capacity of the project is zero.

Example 13.4

Using the APV Method with the Certainty Equivalent Method

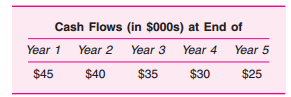

Emruss Ltd. is considering the purchase of a mold to make a new, improved dish drainer. The mold costs $150,000 and lasts five years, after which it has zero salvage value. Analysts estimate the expected unlevered cash flows to be $50,000 per year for the next five years and zero thereafter. The certainty equivalent cash flows, which tend to decline with the horizon when the expected cash flows are constant, are given in the table below:

The mold adds $100,000 to the firm's debt capacity in years 1 and 2, $50,000 in years 3 and 4, and zero in year 5. If Emruss has a borrowing rate of 6 percent and a tax rate of 50 percent, and will use its tax shields with certainty, what is the NPV of this investment if the risk-free rate is 5 percent?