CASE STUDY

Swallowit is a small Australian pharmaceutical company. It is not fully integrated with the dividend imputation system.

As at 30thJune 2012 it had prepared the following Balance Sheet

|

Assets

|

|

|

|

Accounts Receivable

|

$ 125,000

|

|

Inventories

|

|

$ 1,850,000

|

|

Property, Plant & Equipment

|

$ 20,803,000

|

|

Prepayments

|

$ 12,000

|

|

TOTAL ASSETS

|

$ 22,790,000

|

|

|

|

|

|

Liabilities

|

|

|

|

Accounts Payable

|

$ 90,000

|

|

Bank Overdraft

|

$ 1,000,000

|

|

Accrued Revenue

|

$ 25,000

|

|

Debentures

|

|

$ 4,800,000

|

|

TOTAL LIABILITIES

|

$ 5,915,000

|

|

|

|

|

|

NET ASSETS

|

|

$ 16,875,000

|

|

|

|

|

|

Shareholders Equity

|

|

|

Preference Shares

|

$ 2,000,000

|

|

Ordinary Shares

|

$ 10,000,000

|

|

General Reserve

|

$ 125,000

|

|

Retained Profit

|

$ 4,750,000

|

|

TOTAL SHAREHOLDERS EQUITY

|

$ 16,875,000

|

Notes

- The bank overdraft carries an annual percentage rate of 8% charged monthly.

- The debentures are currently trading at $309.29 each. Interest is paid half-yearly and they mature in 7 years time. They were originally issued with a face value of $300 with an annual coupon rate of 13.5%. Any new issues would incur flotation costs of $1.50 per debenture.

- The preference shares are currently trading at $8.10 each. They were originally issued in perpetuity at $8.00. Swallowit has just paid preference dividends totalling $275,000. Any new issues would incur flotation costs of $0.75 per share.

- Ordinary shares are currently trading at $1.75. There are currently 7,500,000 shares outstanding. Swallowit has just paid ordinary dividends totalling $1,125,000. Any new issues would incur flotation costs of $0.50 per share.

- Ordinary dividends over the preceding four years have been as follows

2007-08 $0.1189 per share

2008-09 $0.1276 per share

2009-10 $0.1373 per share

2010-11 $0.1462 per share

Ordinary dividends for 2011-12 have just been paid

- Swallowit has determined that the mix of debt, common stock, and preferred stock that was optimum was the one that the company presently employed. The proportions of this mix had been relatively stable over the past five years.

- Swallowit incorporates its Bank Overdraft in its calculation of The Weighted Average Cost of Capital.

- The company pays tax at a rate of 30%

1. Calculate the Company's Weighted Average Cost of Capital

Swallowit has also asked its commercial bankers what the firm's cost of various types of capital would be, assuming that the present capital structure is maintained. This yielded the following conclusions.

Debt

Up to $1 million of new debt the company can sell debentures at an interest rate of 14 percent. For additional funds above $1 million can issue debentures at an interest cost to the company of 16 percent.

Preferred Stock

Additional preferred stock in the amount of $1.5million can be sold at 14 percent. For additional raisings above $1.5 million this rate would increase by half of a percent.

Common Stock

Up to $4 million of new common can be sold at the current market price. Over $4 million of new common stock can be sold at $1.70 per share.

Management Initiatives

Initiative A

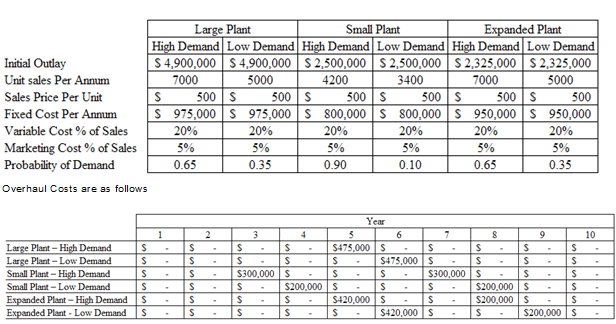

Management is considering a proposed construction of a new plant. Initially they are faced with the choice of either constructing a large or small plant. The expected life span of either construction is estimated to be 10 years. If a choice is made in favour of a small plant, management after three years will expand the small plant to achieve the same output of the large plant if such expansion is warranted.

1. Calculate the Net Present Value and Internal Rate of Return for the three alternatives and advise management.

Initiative B

The general manager has proposed the purchase of one of two large induction distillers to replace its existing distiller. The key financial characteristics of the two proposed distillers are summarised below.

DISTILLER A

This can be purchased for $1,090,000. It will be depreciated under straight line using a four year recovery period. At the end of the four years the machine could be sold to net $380,000 before taxes. If this machine is acquired, it is anticipated that the following current account changes would result.

Cash + $25,400

Accounts Receivable + $70,000

Inventories - $40,000

Accounts Payable + $50,000

DISTILLER B

It costs $1,190,000. It will be depreciated using straight line using a five year recovery period. At the end of five years, it can be sold to net $330,000 before taxes. Acquisition of this press will have no effect on the company's net working capital investment.

2. Calculate the Net Present Value and Internal Rate of Return for both Distillers

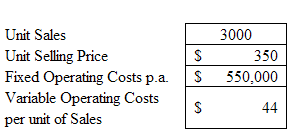

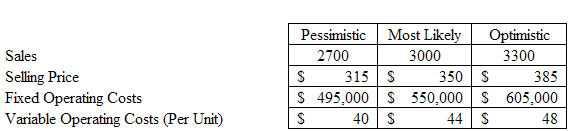

Management has detailed the following scenarios for sales, unit sales price, fixed costs and variable cost per unit for both distillers.

3. Prepare a sensitivity analysis of both distillers.

4. Which of the distillers is preferred? Why?

Initiative C

The company is considering the acquisition of robotic equipment that would radically change its manufacturing process.

- The robotic equipment would cost $3,500,000

- The equipment's useful life is projected to be seven years, and 30 per cent diminishing value depreciation would be used for tax purposes.

- The robotic equipment requires software that will be developed over the first three years. However, the equipment would be fully functional from the beginning of the second year. Each software expenditure, which would amount to $75,000 per year, will be expensed during the year it is incurred.

- A computer systems operator would be hired immediately to oversee the operation of the new robotic equipment. The operator's annual salary would be $86,000, plus on-costs of 40 per cent.

- Maintenance technicians would be needed. The total cost of their wages and on- costs would be $125,000 per year.

- The changeover of the manufacturing line would cost $180,000, to be fully expensed in the first year.

- Several of the company's employees would need retraining to operate the new robotic equipment. The training costs are projected as follows:

First Year $35,000

Second Year $25,000

Third Year $10,000

- An inventory of spare parts for the robotic equipment would be purchased immediately at a cost of $60,000. This investment in working capital would be maintained throughout the life of the equipment. At the end the parts would be sold for $60,000.

- The robotic equipment's salvage value is projected to be $75,000. It would be fully depreciated at that time.

- Apart from the costs specifically mentioned above, management expects that the robotic equipment would save $1,200,000 per year in manufacturing costs.

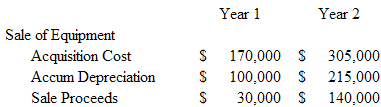

- Switching to the robotic equipment would enable the company to sell some of its manufacturing machinery over the next two years. The following sales schedule is projected:

5. Calculate the Net Present Value and Internal Rate of Return.

6. Assuming that Swallowit maintains this optimum market value capital structure, calculate the breaking points in the Marginal Cost of Capital (MCC) schedule.

7. Calculate Marginal cost of capital in the interval between each of the breaking points and graph the MCC schedule in its step function form.

8. Rank the preferred options within the initiatives according to both internal rates of return and profitability index.