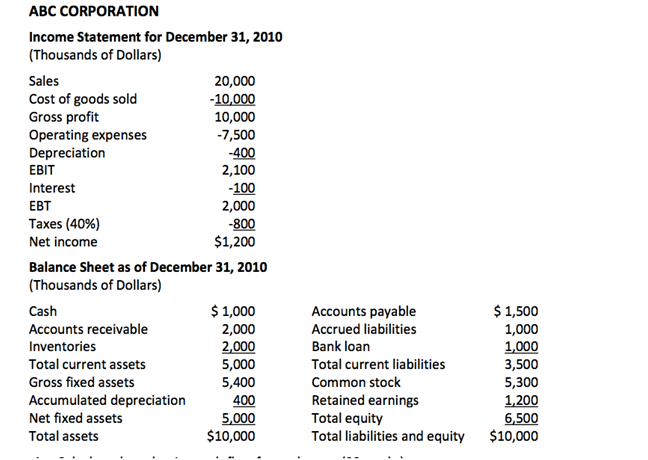

The ABC Corporation has been in operation for one full year (2010). Financial statements follow. ABC's management is interested in determining the value of the venture as of the end of 2010. Sales are expected to grow at a 20 percent annual rate for each of the next three years (2011, 2012, and 2013) before settling down to a long-run growth rate of 7 percent annually. The cost of goods sold is expected to vary with sales. Operating expenses are expected to grow at 75 percent of the sales growth rate (i.e., be semi-fixed) for the next three years before again growing at the same rate as sales beginning in 2014. Individual asset accounts are expected to grow at the same rate as sales. Depreciation can be forecasted either as a percentage of sales or as a percentage of net fixed assets (since net fixed assets are expected to grow at the same rate as sales growth). Accounts payable and accrued liabilities are also expected to grow with sales. ABC's management is interested in determining the equity value of the venture as of the end of 2010. Because ABC is in its start-up life cycle stage, management and venture investors believe that 40 percent is an appropriate discount rate until the firm reaches its long-run or perpetuity growth rate. At that time it will have survived and will become a more typical firm with an estimated cost of equity capital of 20 percent.

A. Calculate the valuation cash flow for each year.

B. Determine ABC's equity value at the end of 2010.

C. Let's assume that ABC management (and owners) have valued the venture as in B above. A VC ?investor is attracted by the company's growth potential and wants to invest $5,000,000 in ABC now (at the end of 2010). What percentage of ownership in the venture should current owners give up to the outside investor for a $5,000,000 new investment?

D. The VC investor used the basic venture capital (VC) method with a 50% hurdle rate and agreed with management valuation. What is ABC's implied net income for 2015 if the P/E ratio of comparable firms is 15?