Performance Drinks: Applying Activity Based Costing

Background:

Performance Drinks, LLC is owned by Dave N. Port. Performance Drinks produces a range of sports centered drinks. They start operations in 1993 shortly after Mr. Port graduated with his M.B.A. from Davenport University. The company saw early success as sports and fitness nutritional products gained new popularity in the year 1990’s. Financially the company is sound and has been wise in controlling their growth over the years. Though, within the last 18 months Mr. Port has noticed a drop in overall company profitability. This is especially troubling considering that the company has continued to experience top-line growth. Mr. Port and his management team have been considering making a new product line. Though, such plans have been put on hold till they can figure out why their profits are shrinking.

Performance Drinks makes four different types of sports drinks. Those drinks are as shown below:

• Basic

• Hydration

• Intensity

• Post-Workout

Each of such drinks contains a slightly different nutritional profile and is targeted for various users and uses. The Basic drink has the least nutritional benefit and is targeted for general consumption. The Hydration product targets endurance athletes and specializes in hydration replacement. The Intensity product was designed with energy enhancement in mind. It serves the requirements of extreme athletes who require long durations of sustained energy. Lastly, the Post-Workout product is a nutritional replacement product that is usually used following exertion.

You are the Controller for Performance Drinks. You feel as though you have a good handle on the financial reporting and the overall company performance. Though, admittedly, your accounting information system has been designed to serve the requirements of external users from an aggregate perspective. To that end you utilize absorption costing exclusively within the organization. You recall studying the concept of Activity Based Management (ABM) and Activity Based Costing (ABC) while taking a managerial accounting course. You wonder if applying such ideas to your business would help to uncover the mystery of the disappearing profits.

You recall from your Management Accounting class that product costs are included of:

• Direct Materials

• Direct Labor

• Manufacturing Overhead

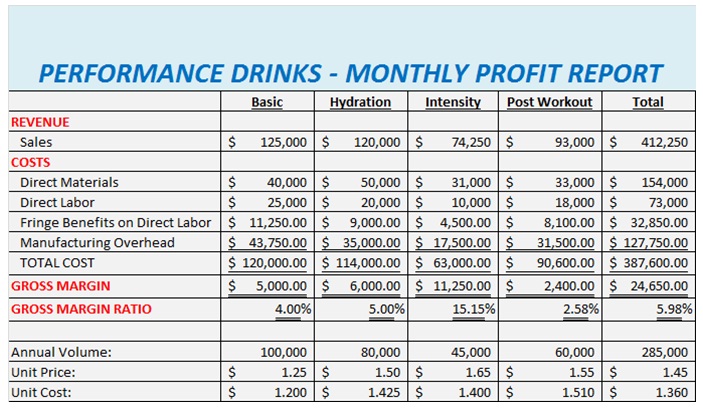

You do not suspect that anything strange is going with your direct costs. You do wonder, though, if a more thorough understanding of your indirect costs may be in order. Over a series of weeks you talk with a variety of employees, representing a multitude of functional areas, from within the company. Throughout those conversations you take careful note on what activities might be consuming resources and how such activities might be measured. You sharpen your pencil and start to unpack what you have learned. You begin with reviewing last month’s Product-Level Profit Report. That report is shown below:

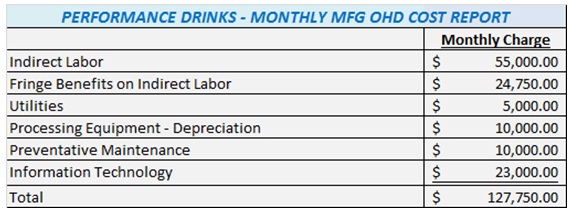

As your primary area of focus is on the indirect costs you compile the given report which further details your overhead charges:

Overhead Activities:

By using traditional costing techniques, which support your absorption costing system, you base overhead allocation on direct labor cost. Moreover, ‘fringe benefits’ are a function of direct labor cost.

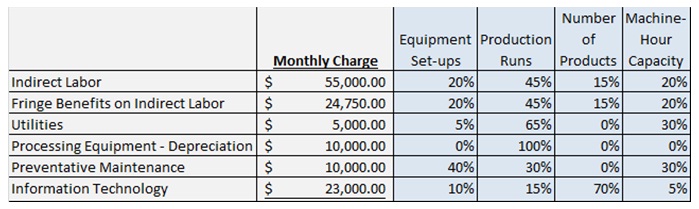

As an outcome of your many meetings to discuss company overhead you find out that the majority of your indirect costs are associated to four primary activities. Those activities are equipment set-ups, production runs, production management and machine-hour capacity. ‘Production Management’ refers to a number of items which are correlated to the number of products the company produces. Ultimately you find out that your key activities have the following usage patterns, as they pertain to the monthly overhead costs:

On reviewing budget data from the last budget cycle you discover that the monthly number of set-ups was estimated to be 85. The number of production runs was estimated to be 250. That monthly machine-hour capacity is presently at 20,000 machine-hours. Lastly, Performance Drinks produces a total of four products.

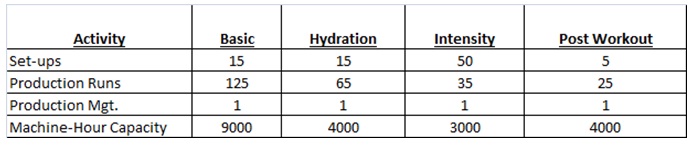

After talking with the Plant Manger you create the given usage data relative to products and activities:

Requirements:

1) Based on all of the date provided, find out the cost driver rates for each of the four activities.

2) find out the per unit product costs for each of the four products. find out this cost using ABC allocation for overhead. Show the computation for each per unit product cost in detail.

3) Make a ‘Monthly Profit Report’. Create this report by using the results of your ABC overhead allocation.

4) Prepare a written ‘Management Report’ which describes to the management team what Activity Based Costing is, how it was used to generate the Monthly Profit Report (from requirement #3). Describe why the profit for each product is different when comparing the Traditional report with the ABC report. Describe what the company might consider doing, based on all of this information, to stop the erosion of company profits. Defend your recommendations with data.

Additional Consideration:

Mr. Port wonders what would happen to costs if plant capacity was shifted from 20,000 machine-hours a month to 40,000 machine-hours per month.

Requirements:

5) find out the new cost per unit for each of the products considering the increase in capacity. Show the computation for each per unit product cost in detail.

6) What is the cost of the unused capacity if it is supposed that the company has 40,000 machine-hours of capacity but it using 20,000 machine-hours? Amend your ‘Management Report’ to comprise a discussion on how to best use the additional capacity.