Question 1

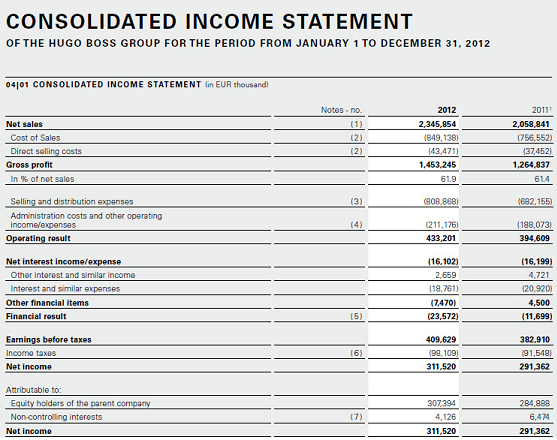

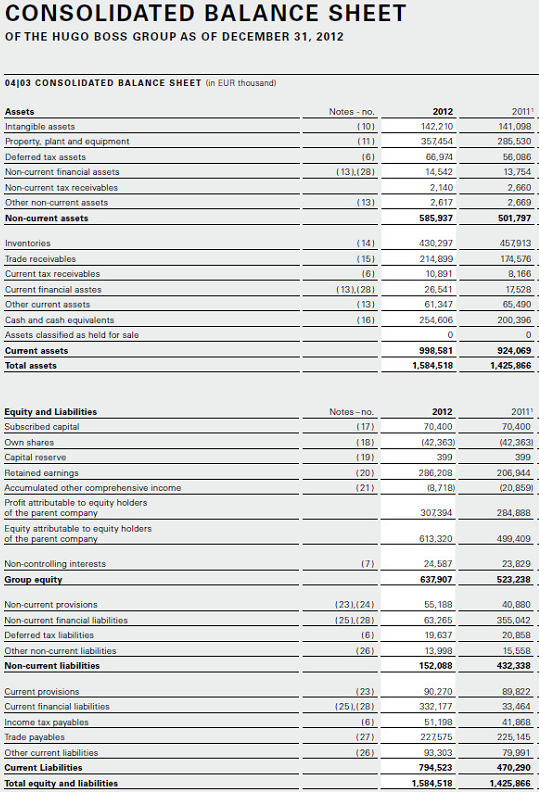

The following are the financial statements for Hugo Boss Group for the financial years ending 2012 and 2011.

Requirements

a) Using the financial statements above (relating to 2012 and 2011), you are required to calculate a series of appropriate ratios relating to liquidity, profitability, efficiency and investment.

b) Analyse the ratios you calculated above, and give an interpretation of the company's performance over these two years in terms of liquidity, profitability, efficiency and investment.

c) Identify each of the stakeholders who may be associated with the Hugo Boss Group, and comment on how each perceive the Hugo Boss Group to be performing using both the ratio analysis above and also any additional publicly available information regarding the Hugo Boss Group, their competitors, the industry or the economy.

Question 2

Viola Ltd is considering 2 potential new investments to enhance its manufacturing plant. These are mutually exclusive options in that the acceptance of any one investment would prevent investment in the other. The organisation uses a net present value (NPV) approach to such decisions and uses its weighted average cost of capital (WACC) as the discount factor within the model.

Currently Viola Ltd has 150,000 x £1 Ordinary shares and £300,000 of debt. The Ordinary Shareholders expect a yield of 6% and the after-tax cost of debt is 9%.

Details of the two investments in the plant enhancement are as follows:

Investment A has an immediate cash outflow of £450,000 and this would be followed by cash inflows of £120,000 year 1, £120,000 year 2, £120,000 year 3 and £200,000 year 4.

Investment B has an immediate cash outflow of £450,000 and this would be followed by cash inflows of £150,000 year 1, £90,000 year 2, £90,000 year 3 and £200,000 year 4.

Assume, for purposes of this case, that the annual cash inflows equate to taxable profits before capital allowances

For both investments, the initial outflow of £450,000 attracts a first year taxation capital allowance of 25% based on the initial investment amount, followed by writing down allowances of 25% of the tax written down value for years 2 and 3. As the investment will be disposed of at the end of year 4 with a nil residual value, the capital allowance to be claimed in year 4 will therefore be a balancing allowance which will reduce the taxation written down value to zero.

[For example if the initial investment had been £100,000, then capital allowances to be claimed would have been £25,000 in year 1, £18,750 for year 2, £14,063 for year 3 and a balancing allowance of £42,188.]

The capital allowances available are offset against taxable profits in each year.

Viola Ltd pays corporation tax at the rate of 22% of its taxable profits after allowing for capital allowances (where applicable). Assume that taxation in respect of year one profits is paid at the end of year two.

Requirements

a) Calculate the net present values and undiscounted and discounted payback periods of each of the proposed investments and recommend which of the two, if any, should be selected. Give detailed reasons for your recommendation.

b) Calculate the Internal Rate of return for both projects and again recommend which of the two projects, if any, should be selected based on this information.

c) Critically analyse the pitfalls / weaknesses of the techniques adopted in parts a and b, and explain why these techniques are still actively used by companies despite these disadvantages, using academic materials to support your discussions.

Question 3

"In recent years, a few businesses have abandoned budgeting, although they still recognize the need for forward planning. No one seriously doubts that there must be appropriate systems in place to steer a business towards its objectives. It is claimed, however, that the systems adopted should reflect a broader, more integrated approach to planning. The new systems that have been implemented are often based around a ‘leaner' financial planning process that is more closely linked to other measurement and reward systems. "

Requirements

Given the sentiment of the quotation above critically discuss the shortcomings of the traditional budgeting technique. Consider how Beyond Budgeting has attempted to address these pitfalls, and comment on whether you believe it to have succeeded.

Referencing style: Harvard style of referencing