Bremen Engineering

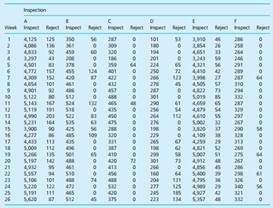

Jurgen Hansmann is the Quality Control Manager of Bremen Engineering. On Tuesday morning he got to work at 7.30 and was immediately summoned by the General Manager. As Jurgen approached, the General Manager threw him a letter that had obviously come in the morning mail. Jurgen saw that the General Manager had circled two sections of the letter in red ink. ‘We have looked at recent figures for the quality of one of the components you supply, AM74021- 74222. As you will recall, we have an agreement that requires 99.5% of delivered units of this product to be within 5% of target output ratings. While your supplies have been achieving this, we are concerned that there has been no apparent improvement in performance over time.' ‘We put considerable emphasis on the quality of our materials, and would like to discuss a joint initiative to raise the quality of your components. By working together we can share ideas and get mutual benefits.' The General Manager waited for a few minutes and said, ‘I find it incredible that we are sending poor quality goods to one of our biggest customers. We have a major complaint about our quality. Complete strangers think that we can't do our job properly, so they'll come and show us how to do it. This is your problem. I suggest you start solving it immediately.' The General Manager's tone made Jurgen rather defensive and his reply was less constructive than normal, ‘There is nothing wrong with our products. We agreed measures for quality and are consistently achieving them. We haven't improved quality because we didn't agree to improve it, and any improvement would increase our costs. We are making 995 units in 1,000 at higher quality than they requested, and the remaining 0.5% are only just below it. To me, this seems a level of quality that almost anyone would be proud of.' The process for making AM74021-74222 has five stages, each of which is followed by an inspection. The units then have a final inspection before being sent to customers. Jurgen now considered more 100% inspections, but each manual inspection costs about €0.60 and the selling price of the unit is only €24.75. There is also the problem that manual inspections are only 80% accurate. Automatic inspections cost €0.30 and are almost completely reliable, but they cannot cover all aspects of quality and at least three inspections have to remain manual. Jurgen produced a weekly summary of figures to show that things were really going well.

For sampling inspections, all production is considered in notional batches of 1 hour's output. Random samples are taken from each batch and if the quality is too low the whole batch is rejected, checked and reworked as necessary.

· A - automatic inspection of all units: rejects all defects

· B - manual inspection of 10% of output: rejects batch if more than 1% of batch is defective

· C - manual inspection of 10% of output: rejects batch if more than 1% of batch is defective

· D - manual inspection of 5% of output: rejects batch if more than 2% of batch is defective

· E - automatic inspection of all units: rejects all defects

· F - manual inspection of 5% of output: rejects batch if more than 1% of batch is defective

Questions

1. Do you think the General Manager's view is reasonable? What about Jurgen Hansmann's reaction?

2. How effective is quality control at Bremen Engineering?

3. Do you think the product quality needs to be improved? How would you set about this?