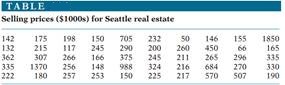

Bootstrap confidence intervals for the standard deviation. We would like a 95% confidence interval for the standard deviation σ of Seattle real estate prices. Your work in given Exercise probably suggests that it is risky to bootstrap the sample standard deviation s from the sample in Table 16.1 and use the bootstrap t interval. Now we have more accurate methods. Bootstrap s and report all four bootstrap 95% confidence intervals: t, percentile, BCa, and tilting.

Make a graphical comparison by drawing a vertical line at the original s and displaying the four intervals horizontally, one above the other. Discuss what you see: Do bootstrap t and percentile agree? Do the more accurate intervals agree with the two simpler methods? What interval would you use in a report on real estate prices?

Exercise

Bootstrap distribution of the standard deviation s. For Example 16.5 we bootstrapped the 25% trimmed mean of the 50 selling prices in given Table. Another statistic with a sampling distribution that is unfamiliar to us is the standard deviation s. Bootstrap s for these data. Discuss the shape and bias of the bootstrap distribution. Is the bootstrap t confidence interval for the population standard deviation σ justified? If it is, give a 95% confidence interval.