BANKING AND FINANCIAL INTERMEDIATION EXERCISE SET

PROBLEM 1 - A banker has just opened a bank. Because it is brand new, its balance sheet is empty (i.e., assume there is no equity). He can collect 1,000 dollars from depositors. The (net) interest rate on deposits will be 20% if he decides to collect. He has three investment opportunities: the first project yields 1.1 dollars next year for each dollar invested. The second project yields either nothing or 2 dollars with equal probability for each dollar invested. The third project yields nothing, 1 dollar, or 4 dollars with probabilities 3/5, 1/5, 1/5. Calculate NPV of each project. Will the banker collect deposits? If yes, in which project(s) will he invest?

PROBLEM 2 - Consider the game below. What should X be for (U, R) to be the unique equilibrium?

|

|

L

|

R

|

|

U

|

3, -2

|

5, 10

|

|

D

|

X, 6

|

-2, 4

|

PROBLEM 3 - Find all equilibria of the game below:

|

|

a

|

b

|

c

|

d

|

|

I

|

1, 1

|

2, 2

|

1, 0

|

3, 3

|

|

II

|

2, 2

|

5, 3

|

3, 4

|

2, 0

|

|

III

|

3, 4

|

1, 0

|

0, 2

|

1, 4

|

|

IV

|

4, 3

|

3, 5

|

2, 3

|

4, 2

|

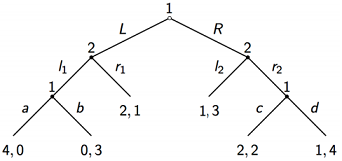

PROBLEM 4 - Consider the game below. Numbers at the top of each node represent player 1 and 2. First, player 1 moves and selects between L and R. Then, game continuous with player 2's move. Find the subgame perfect equilibrium of the game.

PROBLEM 5 - Suppose there are two investment opportunities. The first project yields 1 dollar next year for each dollar invested. The second project yields either nothing or 3 dollars with equal probability for each dollar invested. You have 100 dollars. You will invest all your wealth in these projects and then consume everything you will get (denote by X) next year. How will you allocate your wealth over these two investment opportunities if your utility function is ln X?

PROBLEM 6 - Solve the optimal effort for the course defined on slide 44 of lecture notes.

One day before the exam, each student decides how many hours to spend on preparing for the exam.

If a student studies x hours and if the average hours the rest of the class spends on studying is x¯, then the probability that the student will receive a good grade is x/x+x¯.

The cost of studying is x2/800 and if the student receives a good grade his utility increases by 1.

Who are players?

What is Θ (i.e., their strategy space)?

Hint: Assume that students are identical and their solutions at the end will be the same.

Attachment:- Lecture Notes.rar