At the end of the economic exercise corresponding to the year 2012, a company presents the following financial statuses. (in millions of euros and after the distribution of the profits)

1: Balance sheet

|

Assets

|

|

Liabilities

|

|

|

GrossFixedAssets

|

200

|

Capital Stock

|

50

|

|

Amortization

|

20

|

Retainedearnings

|

70

|

|

Net FixedAssets

|

180

|

Long-term

|

100

|

|

Stock

|

10

|

Accountspayable

|

25

|

|

Clients

|

50

|

|

|

|

LiquidAssets

|

5

|

|

|

|

Total

|

245

|

Total

|

245

|

Aditional Information:

a. The nominal value of each share is 10 euros.

b. The price of the shares in the stock market is 40 euros.

c. The Beta coefficient of the shares is 1.3.

d. The profitability of long-term public debt is 5%.

e. The desired profitability of the stock market is 10%.

f. The company is subject to a tax rate of 30% of earnings.

g. The long-term liabilities correspond to a 5-year loan that will amortize completely in 6 years and accrue an annual interest rate of 6% payable for past years.

h. The composition of fixed assets is as below:

- Buildings and constructions 120

- Machinery and facilities 20

- Transportation vehicles 5

- Other assets 45

2 - Profit and Lost Account

Sales 200.0

Costs of Sales 100.0

Personnel Expenses 30.0

Operational Costs 30.0

Amortizations 10.0

BAIT 30.0

Financial Expenses 6.0

BAT 24.0

Taxes 8.4

BDT 15.6

FORECASTS:

- At the end of the year 2014 the company foresees an expansion investment of its productive facilities at an estimated cost of 20 million euros.

- The company predicts that the rate of amortization of the fixed assets will remain the same.

- It doesn't foresee any change in the policy of the working capital. The percentage of sales will remain constant.

- It estimates an annual accumulative increase of 10% in sales.

- The cost of sales percentage of sales will remain constant.

- The personnel expenses will increase at 5% each year accumulatively.

- The operational costs will increase at 6% each year accumulatively.

Determine the value of this company using FREE CASH FLOW.

Notes from class:

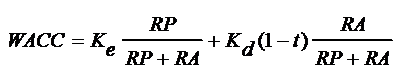

Free Cash Flow = WACC after taxes

Same as flow of net funds after taxes generated by operations, without taking into account debt.

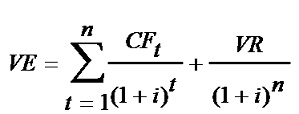

Discount cash flow:

Calculating residual value:

a. Value of Assets/Equity

b. Value of liquidation