Assignment: Updating salary survey data.

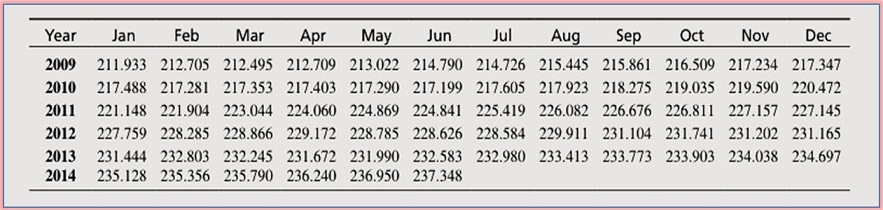

As a newly hired compensation analyst, you've been asked by the Director of Compensation to assist with the preparation of next year's compensation plan. The period for the compensation plan is January 1 - December 31, 2015. Your assignment is to update salary survey data using the CPI-U to estimate new salary information. Also, assume that it is July 1, 2014, and you have been asked to submit your analysis within the next two days. The salary survey data were current through the end of 2013, and the initial average salary reported for accountant jobs in the survey was $50,000. The salary data will be 12 and 24 months old at the pay plan's implementation (on January 1, 2015) and end (December 31, 2015), respectively. You have been provided with national CPI-U data, which were obtained from the BLS website.(Show your work)

Question

1. By what percent did the cost of goods and services change between December 2013 and June 2014?

2. (A) By what percent might you expect the average cost of goods and services to change over the second 6-month period of 2014? Hint: First, calculate the percentage cost change for the period July through December for each of the previous years: 2009 through 2013. Second, take the average of these five figures. This calculation gives us the average percent cost change. We often rely on multiple years for estimations to give us a more stable picture of percent cost changes. (B) What is the estimated average salary for December 31, 2014? Hint: [(initial average salary × average percent cost change) + initial average salary] × 100%.

3. (A) By what percent might you expect the average cost of goods and services to change between January 1, 2015 and December 31, 2015? Hint: First, calculate the percent cost change for the period January through December for each of the previous years: 2009 through 2013. Second, take the average of these five figures to calculate the average percent cost change.

(B) What is the estimated average salary for December 31, 2015? Hint: [(December 2014 average salary × average percentage cost change) + December 2014 average salary] × 100%.

b. Calculating pay range Minimums, Maximums, and pay range overlap.

You have been assigned to calculate the pay range minimum and maximum values for two pay grades as well as the overlap between these two pay ranges. (Show your work)

Questions:

4. Pay Range A: For a pay range midpoint equal to $47,500, calculate the minimum and maximum pay values for a 15 percent range spread.

5. Pay Range B: For a pay range midpoint equal to $53,750, calculate the minimum and maximum pay rates for a 25 percent range spread.

6. What is the overlap between pay range A and pay range B?