Answer the following five questions on a separate document. Explain how you reached the answer or show your work if a mathematical calculation is needed, or both.

1. Which of the following statements is CORRECT?

A. If you add enough randomly selected stocks to a portfolio, you can completely eliminate all of the market risk from the portfolio.

B. If you were restricted to investing in publicly traded common stocks, yet you wanted to minimize the riskiness of your portfolio as measured by its beta, then according to the CAPM theory you should invest an equal amount of money in each stock in the market. That is, if there were 10,000 traded stocks in the world, the least risky possible portfolio would include some shares of each one.

C. If you formed a portfolio that consisted of all stocks with betas less than 1.0, which is about half of all stocks, the portfolio would itself have a beta coefficient that is equal to the weighted average beta of the stocks in the portfolio, and that portfolio would have less risk than a portfolio that consisted of all stocks in the market.

D. Market risk can be eliminated by forming a large portfolio, and if some Treasury bonds are held in the portfolio, the portfolio can be made to be completely riskless.

E. A portfolio that consists of all stocks in the market would have a required return that is equal to the riskless rate.

2. Jane has a portfolio of 20 average stocks, and Dick has a portfolio of 2 average stocks. Assuming the market is in equilibrium, which of the following statements is CORRECT?

A. Jane's portfolio will have less diversifiable risk and also less market risk than Dick's portfolio.

B. The required return on Jane's portfolio will be lower than that on Dick's portfolio because Jane's portfolio will have less total risk.

C. Dick's portfolio will have more diversifiable risk, the same market risk, and thus more total risk than Jane's portfolio, but the required (and expected) returns will be the same on both portfolios.

D. If the two portfolios have the same beta, their required returns will be the same, but Jane's portfolio will have less market risk than Dick's.

E. The expected return on Jane's portfolio must be lower than the expected return on Dick's portfolio because Jane is more diversified.

3. Stock X has a beta of 0.7 and Stock Y has a beta of 1.3. The standard deviation of each stock's returns is 20%. The stocks' returns are independent of each other, i.e., the correlation coefficient, r, between them is zero. Portfolio P consists of 50% X and 50% Y. Given this information, which of the following statements is CORRECT?

A. Portfolio P has a standard deviation of 20%.

B. The required return on Portfolio P is equal to the market risk premium (rM - rRF).

C. Portfolio P has a beta of 0.7.

D. Portfolio P has a beta of 1.0 and a required return that is equal to the riskless rate, rRF.

E. Portfolio P has the same required return as the market (rM).

4. Which of the following statements is CORRECT?

A. When diversifiable risk has been diversified away, the inherent risk that remains is market risk, which is constant for all stocks in the market.

B. Portfolio diversification reduces the variability of returns on an individual stock.

C. Risk refers to the chance that some unfavorable event will occur, and a probability distribution is completely described by a listing of the likelihoods of unfavorable events.

D. The SML relates a stock's required return to its market risk. The slope and intercept of this line cannot be controlled by the firms' managers, but managers can influence their firms' positions on the line by such actions as changing the firm's capital structure or the type of assets it employs.

E. A stock with a beta of -1.0 has zero market risk if held in a 1-stock portfolio.

5. Which of the following statements is CORRECT?

A. If Mutual Fund A held equal amounts of 100 stocks, each of which had a beta of 1.0, and Mutual Fund B held equal amounts of 10 stocks with betas of 1.0, then the two mutual funds would both have betas of 1.0. Thus, they would be equally risky from an investor's standpoint, assuming the investor's only asset is one or the other of the mutual funds.

B. If investors become more risk averse but rRF does not change, then the required rate of return on high-beta stocks will rise and the required return on low-beta stocks will decline, but the required return on an average-risk stock will not change.

C. An investor who holds just one stock will generally be exposed to more risk than an investor who holds a portfolio of stocks, assuming the stocks are all equally risky. Since the holder of the 1-stock portfolio is exposed to more risk, he or she can expect to earn a higher rate of return to compensate for the greater risk.

D. There is no reason to think that the slope of the yield curve would have any effect on the slope of the SML.

E. Assume that the required rate of return on the market, rM, is given and fixed at 10%. If the yield curve were upward sloping, then the Security Market Line (SML) would have a steeper slope if 1-year Treasury securities were used as the risk-free rate than if 30-year Treasury bonds were used for rRF.

1. Which of the following statements is CORRECT?

A. The constant growth model takes into consideration the capital gains investors expect to earn on a stock.

B. Two firms with the same expected dividend and growth rates must also have the same stock price.

C. It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant.

D. If a stock has a required rate of return rs = 12%, and if its dividend is expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

E. The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate.

2. Stocks A and B have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A B

Price $25 $25

Expected growth (constant) 10% 5%

Required return 15% 15%

A. Stock A's expected dividend at t = 1 is only half that of Stock B.

B. Stock A has a higher dividend yield than Stock B.

C. Currently the two stocks have the same price, but over time Stock B's price will pass that of A.

D. Since Stock A's growth rate is twice that of Stock B, Stock A's future dividends will always be twice as high as Stock B's.

E. The two stocks should not sell at the same price. If their prices are equal, then a disequilibrium must exist.

3. Which of the following statements is CORRECT?

A. A major disadvantage of financing with preferred stock is that preferred stockholders typically have supernormal voting rights.

B. Preferred stock is normally expected to provide steadier, more reliable income to investors than the same firm's common stock, and, as a result, the expected after-tax yield on the preferred is lower than the after-tax expected return on the common stock.

C. The preemptive right is a provision in all corporate charters that gives preferred stockholders the right to purchase (on a pro rata basis) new issues of preferred stock.

D. One of the disadvantages to a corporation of owning preferred stock is that 70% of the dividends received represent taxable income to the corporate recipient, whereas interest income earned on bonds would be tax free.

E. One of the advantages to financing with preferred stock is that 70% of the dividends paid out are tax deductible to the issuer.

4. Church Inc. is presently enjoying relatively high growth because of a surge in the demand for its new product. Management expects earnings and dividends to grow at a rate of 25% for the next 4 years, after which competition will probably reduce the growth rate in earnings and dividends to zero, i.e., g = 0. The company's last dividend, D0, was $1.25, its beta is 1.20, the market risk premium is 5.50%, and the risk-free rate is 3.00%. What is the current price of the common stock?

A. $26.77

B. $27.89

C. $29.05

D. $30.21

E. $31.42

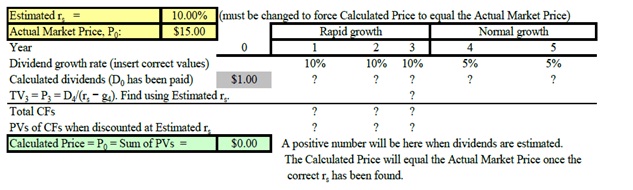

5. Your boss, Sally Maloney, treasurer of Fred Clark Enterprises (FCE), asked you to help her estimate the intrinsic value of the company's stock. FCE just paid a dividend of $1.00, and the stock now sells for $15.00 per share. Sally asked a number of security analysts what they believe FCE's future dividends will be, based on their analysis of the company. The consensus is that the dividend will be increased by 10% during Years 1 to 3, and it will be increased at a rate of 5% per year in Year 4 and thereafter. Sally asked you to use that information to estimate the required rate of return on the stock, rs, and she provided you with the following template for use in the analysis.

Sally told you that the growth rates in the template were just put in as a trial, and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV. She also notes that the estimated value for rs, at the top of the template, is also just a guess, and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price. She suggests that, after you have put in the correct dividends, you can manually calculate the price, using a series of guesses as to the Estimated rs. The value of rs that causes the calculated price to equal the actual price is the correct one. She notes, though, that this trial-and-error process would be quite tedious, and that the correct rs could be found much faster with a simple Excel model, especially if you use Goal Seek. What is the value of rs?

a. 11.84%

b. 12.21%

c. 12.58%

d. 12.97%

e. 13.36%