problem 1: Suppose that the risk-free rate is 5% and that the market risk premium is 7%. If stock has a required rate of return of 13.75%, determine its beta?

a) 1.25

b) 1.35

c) 1.37

d) 1.60

e) 1.96

problem 2: An investor is making a portfolio by investing $50,000 in stock A which consists of a beta of 1.50, and $25,000 in stock B which consists of a beta of 0.90. The market risk premium is equivalent to 2% and Treasury bonds have a yield of 4%. Determine the required rate of return on the investor's portfolio?

a) 6.6%

b) 6.8%

c) 5.8%

d) 7.0%

e) 7.5%

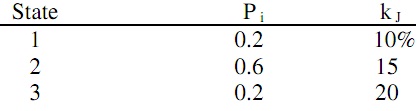

problem 3: The probability distribution is shown; determine the expected return and the standard deviation of returns for Security J?

a) 15%; 6.50%

b) 12%; 5.18%

c) 15%; 3.16%

d) 15%; 10.00%

e) 20%; 5.00%

problem 4: If D1 = $2.00, g (which is constant) = 6% and P0 = $40, determine the stocks expected total return for the coming year?

a) 10.8%

b) 11.0%

c) 11.2%

d) 11.4%

e) 11.6%

problem 5: A stock is expected to pay a dividend of $1 at the end of year. The required rate of return is rs = 11% and the expected constant growth rate is 5%. Determine the current stock price?

a) $16.67

b) $18.83

c) $20.00

d) $21.67

e) $23.33