Question 1:

A 5-year bond with face value of $1000 makes annual coupon payments of $80 and is currently selling at par. Calculate the return you will earn if you buy the bond now and sell it at the end of the current year when bond is expected to have a yield to maturity of 6 per cent.

Question 2:

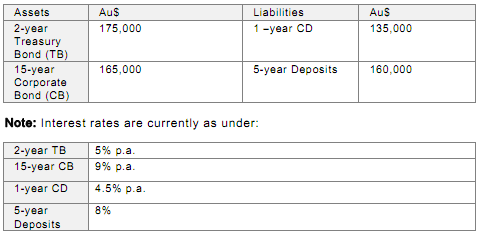

Table 1 is an excerpt of MM Bank's balance sheet. Use the balance sheet

information and the notes underneath to answer questions a through c.

Table 1: Excerpt of the balance sheet of MM Bank Limited.

Note: Interest rates are currently as under:

Assume that all instruments are currently selling at par (equal to book value) and that the frequency of interest payment is once a year for all instruments.

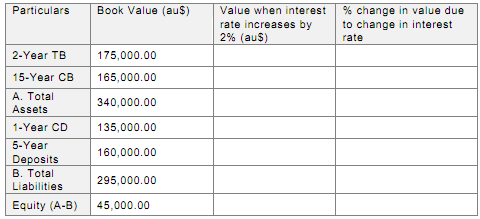

a. Fill Table 2 to show the impact on the Bank's equity of a 2% change in all interest rates. Provide working below the table.

Table 2: Impacts on equity for a 2% change in the interest rates.

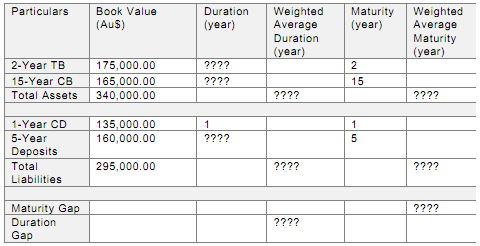

b. Calculate duration at the current rate of interest (see notes under Table 2.1) of each instrument, the weighted average duration of assets and liabilities, and the weighted average maturities of assets and liabilities, and the duration and maturity gaps. Insert your results in the marked (????) cells of Table 2.3. Show workings under the table.

Table 3: Maturity and Duration Gap

c. What do the gap estimates say about the Bank's exposure to the interest rate risk? What is the economic interpretation of the duration gap?