1:

Suppose the term structure of risk-free interest rates is as shown below:

- a.Calculate the present value of an investment that pays $1000 in two years and $2000 in five years for certain.

- b.Calculate the present value of receiving $500 per year, with certainty, at the end of the next five years. To find the rates for the missing years in the table, linearly interpolate between the years for which you do know the rates. (For example, the rate in year 4 would be the average of the rate in year 3 and year 5.)

*c. Calculate the present value of receiving $2300 per year, with certainty, for the next 20 years. Infer rates for the missing years using linear interpolation. (Hint: Use a spreadsheet.)

|

Term

|

1 year

|

2 years

|

3 years

|

5 years

|

7 years

|

10 years

|

20 years

|

|

Rate (EAR, %)

|

1.99

|

2.41

|

2.74

|

3.32

|

3.76

|

4.13

|

4.93

|

2.

Using the term structure in Problem 29, what is the present value of an investment that pays $100 at the end of each of years 1, 2, and 3? If you wanted to value this investment correctly using the annuity formula, which discount rate should you use?

3. Suppose the current one-year interest rate is 6%. One year from now, you believe the economy will start to slow and the one-year interest rate will fall to 5%. In two years, you expect the economy to be in the midst of a recession, causing the Federal Reserve to cut interest rates drastically and the one-year interest rate to fall to 2%. The one-year interest rate will then rise to 3% the following year, and continue to rise by 1% per year until it returns to 6%, where it will remain from then on.

- a.If you were certain regarding these future interest rate changes, what two-year interest rate would be consistent with these expectations?

- b.What current term structure of interest rates, for terms of 1 to 10 years, would be consistent with these expectations?

- c.Plot the yield curve in this case. How does the one-year interest rate compare to the 10-year interest rate?

3. The following table summarizes prices of various default-free, zero-coupon bonds (expressed as a percentage of face value):

|

Maturity (years)

|

1

|

2

|

3

|

4

|

5

|

|

Price (per $100 face value)

|

$95.51

|

$91.05

|

$86.38

|

$81.65

|

$76.51

|

- a. Compute the yield to maturity for each bond.

- b.Plot the zero-coupon yield curve (for the first five years).

- c.Is the yield curve upward sloping, downward sloping, or flat?

4.

In the Global Financial Crisis box in Section 6.1, Bloomberg.com reported that the three-month Treasury bill sold for a price of $100.002556 per $100 face value. What is the yield to maturity of this bond, expressed as an EAR?

5.

The prices of several bonds with face values of $1000 are summarized in the following table:

|

Bond

|

A

|

B

|

C

|

D

|

|

Price

|

$972.50

|

$1040.75

|

$1150.00

|

$1000.00

|

For each bond, state whether it trades at a discount, at par, or at a premium.

6.

Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $1000, and a coupon rate of 7% (annual payments). The yield to maturity on this bond when it was issued was 6%.

- a.What was the price of this bond when it was issued?

- b.Assuming the yield to maturity remains constant, what is the price of the bond immediately before it makes its first coupon payment?

- c.Assuming the yield to maturity remains constant, what is the price of the bond immediately after it makes its first coupon payment?

7.

Andrew Industries is contemplating issuing a 30-year bond with a coupon rate of 7% (annual coupon payments) and a face value of $1000. Andrew believes it can get a rating of A from Standard and Poor's. However, due to recent financial difficulties at the company, Standard and Poor's is warning that it may downgrade Andrew Industries bonds to BBB. Yields on A-rated, long-term bonds are currently 6.5%, and yields on BBB-rated bonds are 6.9%.

- a.What is the price of the bond if Andrew maintains the A rating for the bond issue?

- b.What will the price of the bond be if it is downgraded?

8.

The Isabelle Corporation rents prom dresses in its stores across the southern United States. It has just issued a five-year, zero-coupon corporate bond at a price of $74. You have purchased this bond and intend to hold it until maturity.

- a.What is the yield to maturity of the bond?

- b.What is the expected return on your investment (expressed as an EAR) if there is no chance of default?

- c.What is the expected return (expressed as an EAR) if there is a 100% probability of default and you will recover 90% of the face value?

- d.What is the expected return (expressed as an EAR) if the probability of default is 50%, the likelihood of default is higher in bad times than good times, and, in the case of default, you will recover 90% of the face value?

- e.For parts (b-d), what can you say about the five-year, risk-free interest rate in each case?

9.

The following table shows the one-year return distribution of Startup, Inc. Calculate

- a.The expected return.

- b.The standard deviation of the return.

|

Probability

|

40%

|

20%

|

20%

|

10%

|

10%

|

|

Return

|

-100%

|

-75%

|

-50%

|

-25%

|

1000%

|

10.

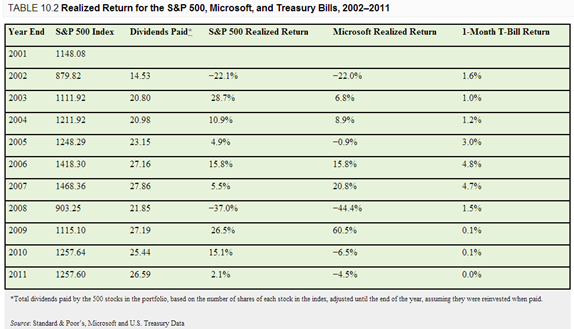

- a.What was the average dividend yield for the SP500 from 2002-2011?

- b.What was the volatility of the dividend yield?

- c.What was the average annual return of the SP500 from 2002-2011 excluding dividends (i.e., from capital gains only)?

- d.What was the volatility of the S&P 500 returns from capital gains?

- e.Were dividends or capital gains a more important component of the S&P 500's average returns during this period? Which were the more important source of volatility?

11.

What is an efficient portfolio?

12.

Given the results to Problem 35, why don't all investors hold Autodesk's stock rather than Hershey's stock?

13.

State whether each of the following is inconsistent with an efficient capital market, the CAPM, or both:

- a.A security with only diversifiable risk has an expected return that exceeds the risk-free interest rate.

- b.A security with a beta of 1 had a return last year of 15% when the market had a return of 9%.

- c.Small stocks with a beta of 1.5 tend to have higher returns on average than large stocks with a beta of 1.5.

14.

Consider a world that only consists of the three stocks shown in the following table:

|

Stock

|

Total Number of Shares Outstanding

|

Current Price per Share

|

Expected Return

|

|

First Bank

|

100 Million

|

$100

|

18%

|

|

Fast Mover

|

50 Million

|

$120

|

12%

|

|

Funny Bone

|

200 Million

|

$30

|

15%

|