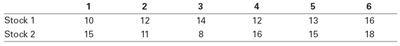

1.Consider the price paths of the following two stocks over six time periods:

Neither stock pays dividends. Assume you are an investor with the disposition effect and you bought at time 1 and right now it is time 3. Assume throughout this question that you do no trading (other than what is specified) in these stocks.

a. Which stock(s) would you be inclined to sell? Which would you be inclined to hold onto?

b. How would your answer change if right now is time 6?

c. What if you bought at time 3 instead of 1 and today is time 6?

d. What if you bought at time 3 instead of 1 and today is time 5?

2.Suppose that all investors have the disposition effect. A new stock has just been issued at a price of $50, so all investors in this stock purchased the stock today. A year from now the stock will be taken over, for a price of $60 or $40 depending on the news that comes out over the year. The stock will pay no dividends. Investors will sell the stock whenever the price goes up by more than 10%.

a. Suppose good news comes out in 6 months (implying the takeover offer will be $60). What equilibrium price will the stock trade for after the news comes out, that is, the price that equates supply and demand?

b. Assume that you are the only investor who does not suffer from the disposition effect and your trades are small enough to not affect prices. Without knowing what will actually transpire, what trading strategy would you instruct your broker to follow?

3.Davita Spencer is a manager at Half Dome Asset Management. She can generate an alpha of 2% a year up to $100 million. After that her skills are spread too thin, so cannot add value and her alpha is zero. Half Dome charges a fee of 1% per year on the total amount of money under management (at the beginning of each year). Assume that there are always investors looking for positive alpha and no investor would invest in a fund with a negative alpha. In equilibrium, that is, when no investor either takes out money or wishes to invest new money,

a. What alpha do investors in Davita’s fund expect to receive?

b. How much money will Davita have under management?

c. How much money will Half Dome generate in fee income?

4.Assume the economy consisted of three types of people. 50% are fad followers, 45% are passive investors, they have read this book and so hold the market portfolio, and 5% are informed traders. The portfolio consisting of all the informed traders has a beta of 1.5 and an expected return of 15%. The market expected return is 11%. The risk-free rate is 5%.

a. What alpha do the informed traders make?

b. What is the alpha of the passive investors?

c. What is the expected return of the fad followers?

d. What alpha do the fad followers make?