1. List three key financial statements and identify the kinds of information they provide to corporate managers, investors and creditors. Please provide an example of each.

2. What is the difference between an ordinary annuity and an annuity due? Discuss and show an example of how you would use each one. Explain what a perpetuity is and used by a providing a REAL company example.

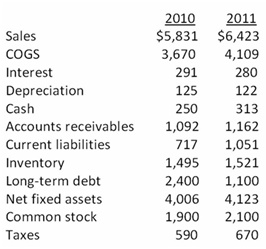

3. What is the cash flow to stockholders for 2011? Discuss what this means!

4.Calculate the following ratios for High Tech Company (shown on next page) and please show ALL your work. Compare and briefly discuss your answers (2012) to the company's historic averages and to the industry average for full credit. Discuss the five overall categories of ratios briefly explaining the importance of each to the company. How do you think this company is doing? Why?

2012 Company Industry

Current 2.00 2.20

Quick 1.00 1.10

NetWorkingCapital 3.20 4.60

TotalDebt .60 .50

Debt-Equity .40 .35

EquityMultiplier 1.15 1.25

LongTermDebt .32 .38

TimesInterestEarning 4.00 4.50

CashCoverage 5.70 6.50

InventoryTurnover 11.00 12.50

DaysSalesinInventory 20 25

ReceivablesTurnover 9.8 10.3

DaysSalesinReceivables 95 105

FixedAssetTurnover 2.50 2.40

TotalAssetTurnover 1.50 1.40

ProfitMargin 8.00 7.50

ROA 8.54 9.78

ROE&DuPont 11.8 12.60

PriceEarnings 27 35

PEG 1.58 1.25

PricetoSales 1.60 1.75

MarkettoBook 1.45 1.26

EnterpriseValue