problem) Pace Corp. donates the following property to Landon Elementary School:

A car with an adjusted basis of $15,000; current FMV is $18,000. Computer equipment built one year ago at a cost of $1,700 with $4,500 FMV on the contribution date. (Pace manufactures and sells computer equipment.) The school plans to sell the car in an auction and use the proceeds to renovate classrooms to be used as computer laboratories. The computer equipment will be placed in these new classrooms and will be available for students to use for learning and class work.

What is the total of Pace Corp.'s charitable contributions for the year, before any taxable income limitations?

problem) Pace Corp. also reports the following results for the current year:

Gross profit on sales $120,000

NOL carryover from two years ago $10,000

Short-term capital loss $5,000

Dividends from 15%-owned domestic corp. $30,000

Operating expenses $65,000

problem) What are Pace's taxable income and income tax liability? Include the deduction, if any, for charitable contributions find outd in problem 1 and assume qualified production activities income is $55,000 and related W-2 wages are $20,000.

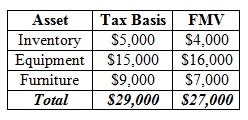

problem) In a §351 transaction, Ava transfers the following assets to O'Hagan Inc. in exchange for all of its stock:

a.What is Ava's basis in the shares?

b.What is the corporation's basis in each asset and overall?

problem) Do the following scenarios qualify as Section 351 nontaxable transfers? If so, for which transferors-shareholders does Section 351 apply?

a. Betty and Archie form East Corporation. Betty performs legal services in exchange for 1,250 shares of East stock. Archie exchanges property for 2,655 shares of East stock.

b. Julian owns all 150 shares of Bubbles Inc. valued at $75,000. Ricky contributes property to Bubbles Inc. in exchange for 45 newly issued shares and Julian also contributes additional property worth $5,000 for 5 new shares.