Attempt all the problems illustrated below.

problem 1: What do you mean by the term Perquisite? What are the provisions associated to perquisite? Describe in detail.

problem 2: What do you understand by the term exempted incomes? Which kinds of exemption does income tax Act gives to incomes?

problem 3: Mr. Sudesh Sold his house on 1st May, 2009 for Rs 12, 00,000. This house was purchased by his father in 1960 for Rs 50,000. Mr. Sudesh got this house in inheritance on the death of his father in1977-78. On 01.04.1981 fair market value of this house was Rs 150,000. On 1st December, 2009 he purchased the other house for Rs 2, 50,000. For the assessment year 2011-12. Compute his capital gains.

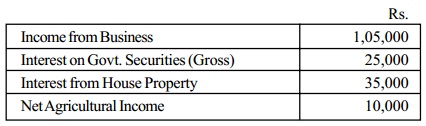

problem 4: Mr. Mukesh submits the given particulars in respect of his income of prior year 2010-11.

find out Income Tax payable by Mr. Mukesh for the assessment year 2011-12.

problem 5: prepare short notes on the given terms:

a) Exempt Capital Gains.

b) Pension.

c) Bond washing Transactions.

d) Residential Status of Assessed.