Part 1: Firm Perspective

1. Use the following article and your own research to answer the following questions:

Competitive dynamics in the banking sector

The Treasury presentation earlier in the week to the Senate inquiry on competition in the banking sector drew attention to a number of significant developments which have, collectively, altered the competitive dynamics of the retail banking sector in recent years.

There has been further consolidation in the Australian banking sector since the global financial crisis.

A consequence of these factors is that the four major banks have expanded their collective market share across a range of loan and deposit products.

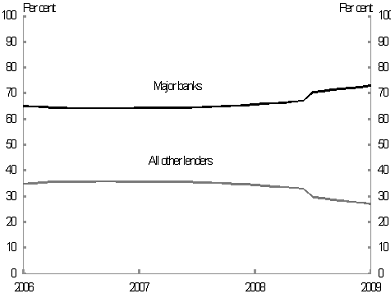

This is illustrated in the home loan market (Chart 5). The share of total housing loan credit for the five largest banks - the four major banks (Commonwealth Bank, NAB, ANZ and Westpac) plus St George - has increased from around 60 per cent before the onset of the GFC in mid-2007 to around 73 per cent.

The Government is seeking to enhance competitive pressures in the provision of retail banking products, including home loans, with the package of measures announced on the weekend. This includes:

• banning exit fees on new home loans;

• examining providing a capacity for consumers to transfer deposits and mortgages between banks;

1. Read the article above and answer the following questions.

a) What type of market do Australian Banks operate in? How has the Global Financial Crisis affected competition in this market? Explain your answer.

b) Assume the biggest four banks in Australia decided to collude and agree to charge a high price on banking products. Graphically demonstrate the price and output in this market and explain your diagram.

2. Briefly describe what triggers entry in a perfectly competitive market and the process that ends further entry. Use and refer to a diagram in your answer.

Part 2: Macroeconomic Perspective

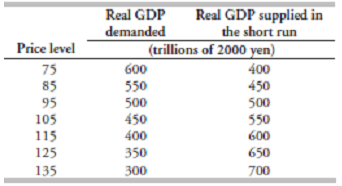

1. In Japan, potential GDP is 600 trillion yen and the table shows the aggregate demand and short-run aggregate supply schedules.

a) What is the short-run equilibrium, real GDP and price level?

b) Does Japan have an inflationary gap or a recessionary gap and what is its magnitude?

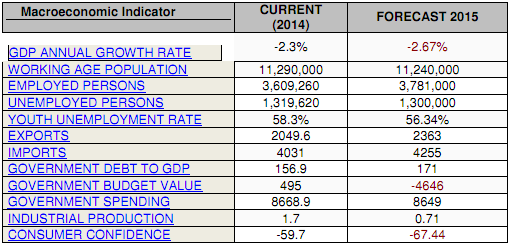

2. Answer the following questions with reference to the below data about Greece.

a) Using the aggregate supply and demand model demonstrate what you think will happen to the Greek economy in 2015 based on the above forecasts.

Justify your answer with reference to the components of Aggregate Demand.

b) What are the problems facing this economy and what fiscal policy can the government undertake to address these problems? How would this fiscal policy affect the Greek economy? Answer your question with reference to your diagram in a).

c) What challenges would face the Greek government if they wanted to undertake fiscal policy to address the problems described in b?

d) Calculate the unemployment and labour force participation rates in 2014 and in 2015 based on the figures provided above.

e) Using the figures you calculated in d) and assuming the forecast figures provided above are correct, what conclusion can you make about how employment in Greece will changed from 2014 to 2015? Will this be a positive or a negative change?

Do not forget to include a reference list for any sources apart from lectures or tutorials. You also need to include in-text references. Both of these will count for.