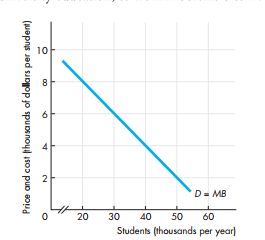

Question: Use the following figure, which shows the demand for university education, to work.

The marginal cost is a constant $6,000 per student per year. The marginal external benefit from a university education is a constant $4,000 per student per year.

If the government offers students vouchers, what is the value of the voucher that will achieve the efficient number of students?