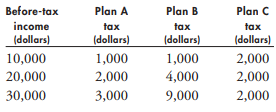

Question: The table shows three redistribution schemes.

a. Which scheme will increase economic inequality? Explain why.

b. Which scheme will reduce economic inequality? Explain why.

c. Which scheme will have no effect on economic inequality? Explain why.