Question: Pixar and Disney

Birth of Pixar: The short, happy tale of Pixar began when John Lasseter left Walt Disney studios in 1984 to join Lucasfilm, Ltd. Two years later, Steve Jobs, CEO of Apple Computer Inc., bought the computer graphics division of Lucasfilm for $10 million and renamed it Pixar. After winning numerous awards for short films and commercials, Pixar, with just 44 employees, teamed up with mega-studio Disney in 1991 to coproduce major films.

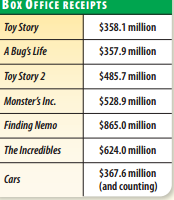

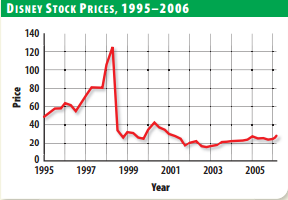

Box Office Magic, Stock Ticker Woes: Toy Story, the first collaboration by Disney and Pixar, was a box office home run, earning $358 million in box office receipts around the world as the highestgrossing film of 1995. The dynamic duo produced six more commercial hits, but Disney's other work did not please moviegoers. Nor did its stock price satisfy stockholders.

Disney's management hoped to boost its stock price and remedy the sometimes tumultuous relationship between Disney and Pixar by entering into merger negotiations.

Animation Merger: By that time, Pixar had grown to a company of hundreds of employees, and federal regulatory authorities reviewed the merger for possible antitrust problems.The two companies finally merged in 2006 when Disney paid $7.5 billion for Pixar. As hoped, the price of Disney stock started to increase. A few months later, Cars zoomed into theaters, bringing in more than $60 million its first weekend. If you think stock prices follow ticket sales, though, think again. Despite that impressive showing, Disney's stock fell slightly when the movie missed its $70 million goal.

Analyzing the Impact Question

1. Summarizing How did Disney expect to gain from the merger with Pixar?

2. Drawing Conclusions Why might federal regulators be concerned about the merger of these two movie companies?