Question: Look at Focus on China's supposed undervaluation. Is it still true that China has a large trade and current account surplus? Are official foreign exchange reserves still rising? If not, what has happened and, more importantly, why?

FOCUS: IS CHINA'S CURRENCY UNDER-VALUED?

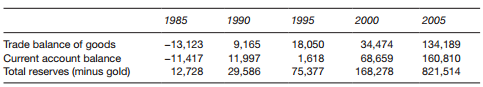

China is often accused of having an under-valued exchange rate. Can you think why some analysts might think this? Consider the following data (all in millions of US$).

Since 1985, China's trade balance in merchandise and the current account balance have gone from a deficit to an increasingly large surplus (except 1995 for the current account) as more foreign exchange has been "earned" than has been "spent." From our discussions above, this is often the result when a currency is under-valued, that is, when it is easy for foreigners to buy the currency. Official foreign exchange reserves have grown rapidly too; total reserves in 2005 exceeded total import expenditures for that year, providing a very comfortable margin of "savings" for the economy. This supports the undervaluation argument. There would seem to be an imbalance, or one would expect the trade balance or the current account to trend toward a lower surplus or small deficit over time if the exchange rate were near its equilibrium value. The problem with this way of looking at China's exchange rate is that the Chinese currency, the renminbi, is not fully convertible. Chinese citizens cannot freely exchange their own currency for euros, dollars, yen, or other foreign exchange. Some analysts argue that if the renminbi were made fully convertible there would be a burst of spending by the Chinese on imports and a rush to make investments abroad that would rapidly undo the trade and current account surplus and put pressure on the government to inject official foreign exchange reserves into the economy. Either that or the exchange rate of the renminbi versus other major currencies would experience a rapid devaluation. What do you think?