Question: In this exercise you will compute pseudo out-of-sample two-quarter-ahead forecasts for ?Y beginning in 1989:4 through the end of the sample. (That is, you will compute

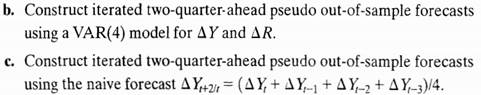

a. Construct iterated two-quarter-ahead pseudo out-of-sample forecasts using an AR(1) model. b.

d. Which model has the smallest root mean squared forecast error?