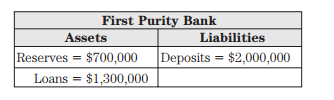

Question: Assume that First Purity Bank begins with a balance sheet below and is fully loaned up. Answer the questions that follow.

a. What is the reserve requirement equal to?

b. If the bank receives a new deposit of $1 million, and the bank wants to remain fully loaned-up, how much of this new deposit will the bank loan out?

c. When the new deposit to First Purity Bank works itself through the entire banking system (assume all banks keep fully loaned-up), what will total deposits, total loans, and total reserves be equal to?

d. What is the potential money multiplier equal to?