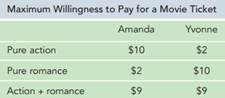

Question: Amanda and Yvonne are thinking of going out to the movies. Amanda likes action flicks more, but Yvonne likes a little bit of romance. Warner Bros. is trying to decide what kind of movies to make this year. Should it make one movie for release this summer, an action flick with a romantic subplot, or should it make two movies for release this summer: an action flick and a romantic drama? Here's the two friends' willingness to pay for the separate kinds of movies. As you can see, both Amanda and Yvonne are annoyed by the idea of a hybrid movie: Each would rather see her favorite kind of movie.

Now, let's look at this from Warner Bros.' point of view. You're the midlevel executive who has to decide which project to green light. Your marketing people have figured out that there are 5 million people like Amanda and 5 million people like Yvonne in the United States, and they'll only see one film per summer. To make things simple, assume that the marginal cost of showing the movie one more time is zero, and that ticket prices are fixed at $8.

a. If the cost of producing any of the three films is $30 million, what should the studio do: make the two films or just the one hybrid film? Of course, the right way to find the answer is to figure out which choice would generate the most profit for Warner Bros.

b. Of course, the hybrid might cost a bit more to make. What if the hybrid costs $40 million to make, the pure action flick $30 million, and the romance a mere $15 million? What's the best choice now: one hybrid or two pure films?

c. Let's see how much prices would have to change for the answer to this question to change. Holding all else equal, how low would the cost of the pure romance film have to fall before the two-movie deal would get the green light?

d. (Hard) There's an underlying principle here: The "unbundled" two-movie deal won't get the green light unless its total cost is less than what? The answer is not a number-it's an idea. Is this likely to happen in the real world? Why or why not?