QUESTION 1

REQUIRED

Study the Information provided below and answer the following questions:

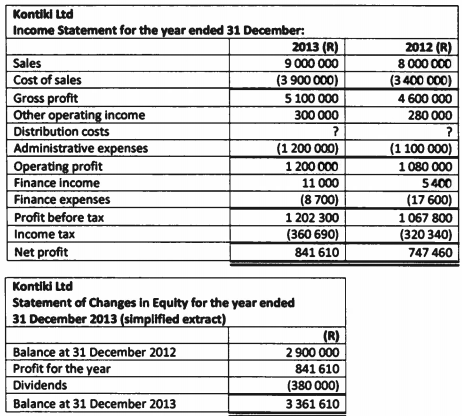

1.1 Explain the changes that possibly took place during 2013 In respect of:

1.1.1 Finandng activities

1.1.2 Investing activities

1.2 Calculate the Distribution costs for 2013.

1.3 Was there a change In the tax rate during 2013? Explain.

1.4 Critically assess the performance of the company from the information provided.

INFORMATION

The Income Statement and simplified extract of the Statement of Changes in Equity for Kontiki Ltd are provided below:

QUESTION 2

REQUIRED

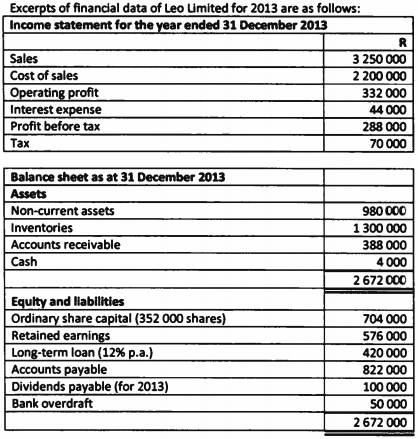

2.1 Use the Information provided below to calculate the ratios for 2013 that would reflect each of the following (Where applicable, round off answers to two decimal places):

2.1.1 The percentage of each sales Rand that remain after all costs and expenses other than interest and taxes are deducted

2.1.2 The number of times more that investors are willing to pay for each Rand of the company's earnings

2.1.3 The proportion of the total assets that are financed by external funding

2.1.4 The ability of the company to repay its short-term debts during adverse business conditions

2.1.5 The Rand amount of distributions during the period on behalf of each ordinary share issued

2.1.6 An indication of the percentage of profit that has been put back into the company

2.2 Comment on the following ratios that have been calculated for Leo Limited. Provide two significant comments for each ratio.

2.2.1 Gross margin

2.2.2 Return on capital employed

QUESTION 3

REQUIRED

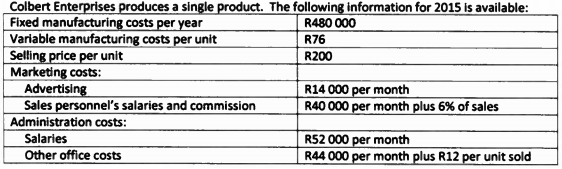

Study the information given below and answer the following questions independently:

3.1 Calculate the contribution margin ratio and thereafter use this ratio to determine the sales value required to achieve an annual operating profit of R1200 000.

3.2 Calculate the margin of safety (as a percentage) for 2015.

3.3 Suppose Colbert Enterprises is considering a R20 per unit decrease in the selling price of the product, with the expectation that this would increase annual sales by 25%. Is this a good Idea? Motivate your answer with the relevant calculations.

3.4 What price does Colbert Enterprises have to charge for each unit of the product to break even, if all 28 000 units produced are sold?

QUESTION 4

4.1 REQUIRED

Study the Information given below and answer the following questions:

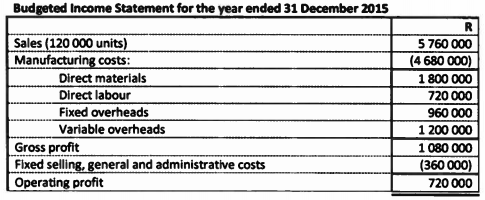

4.1.1 Calculate the total Operating Profit (Loss) for 2015 If the special order is accepted. Based on your calculations, should the special order be accepted? Why?

4.1.2 Calculate the total costs that are relevant to the special order only.

(4) INFORMATION

The following Budgeted Income Statement is for a manufacturer which has received a special order to sell 45 000 units of a product at R33 per unit during January 2015. Planned sales for 2015 (excluding the special order) are 120 000 units which represents 80% of Its plant capacity. The manufacturer has no intention of increasing plant capacity if the special order is accepted.

REQUIRED

Study the information given below and answer the following questions:

4.2.1 Calculate the total Direct Labour Efficiency Variance. Also indicate whether the variance is favourable or unfavourable.

4.2.2 Explain two possible causes of an unfavourable Direct Labour Efficiency Variance.

INFORMATION

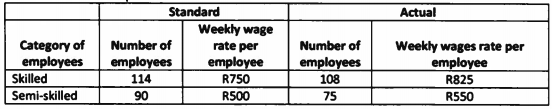

The details regarding the composition and weekly wages of the employees engaged on a job scheduled to be comoleted in 17 weeks are as follows:

QUESTION S

5.1 REQUIRED

Calculate the following from the Information given below:

5.1.1 Accounting Rate of Return (on average Investment)

5.1.2 Calculate the Internal Rate of return. Use interpolation to arrive at your answer.

(5) INFORMATION

Conquesta Umited is considering the purchase of Machine X, details of which are provided below:

5.2 REQUIRED

Study the information given below and determine, on the basis of its Net Present Value (NPV), whether the Investment should be favourably considered.

INFORMATION

Lotus Ltd plans an Investment in non-current assets costing R3 000 000. The non-current assets will have a four year life, with the following expected profits:

Year 1 R324000

Year 2 R720 000

Year 3 R100000

Year 4 R150000

Finance for inventories and debtors amounting to 8200 000 will be required at the start of the project. Trade credit will provide R110 000 of this amount. All the working capital will be recovered at the end of year 4. The expected scrap value of the non-current assets at the end of year 4 Is R375 000. The cost of capital is 12%.