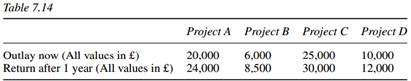

Question: 1. Which of the three projects shown in Table 7.8 is the best investment if the interest rate is 20%?

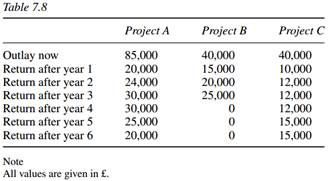

2. Calculate the IRR for the projects in Table 7.14 and then say whether or not the IRR ranking is consistent with the NPV ranking for these projects if the market rate of interest is 15%.