Problem 1.

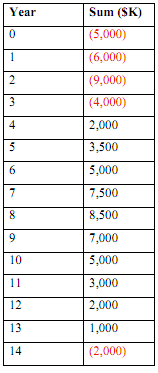

A. Use the spreadsheet to compute the net present value of the following series of cash flows, assuming a discount rate, r = 0.10:

B. Add a column in which to list the year-by-year discount rate, and another column in which to compute the present value of each cash flow when the discount rate is variable. Compute the net present value of the series of cash flows assuming that the discount rate remains constant at 6% in the first 5 years, increase to 8% in years 6, 7 and 8, increases to 10% in years 9, 10, and 11, then jumps to 12% in subsequent years.

Problem 2.

Given a Risk-Free discount rate of 4%, an SP500 return of 8%, and a tax rate of 35%, compute the weighted average cost of capital (WACC) for three companies, whose finances are as follows:

a. Company A: Debt-to-Equity Ratio is 1:4; debt interest rate, rd = 6%; β = 0.75.

b. Company B: Debt-to-Equity Ratio is 1:3; debt interest rate, rd = 7%; β = 1.25.

c. Company C: Debt-to-Equity Ratio is 1:2; debt interest rate, rd = 9%; β = 3.50.

Problem 3.

A company has the potential to earn $100M in the horizon year of a growth product that is expected to have a profit growth of 5% per year in perpetuity beyond the horizon year. If the company's discount rate (WACC) is 12%,

d. Estimate the cash flow to be included in the horizon year.

e. What will be the horizon value if there is no profit growth?

Problem 4.

You are contemplating the purchase of a Honda Civic. At the Honda dealership the salesman offered you two options:

1. A Conventional Honda Civic Sedan for $20,500 plus an 8% sales tax, whose average fuel economy is 29 mpg, and

2. A Hybrid Honda Civic Sedan with the same trim level and options for $23,600 plus an 8% sales tax, whose average fuel economy is 42 mpg.

Both cars have the same warranty, same maintenance and same reliability.

You informed the salesman that you need a few days to evaluate these two options. Back home, you developed a spreadsheet to compare the two options. Your bank offers car loans at 6% simple interest, and you estimated that you can obtain 6% simple interest on investments of any cash you save. Your research led you to the conclusion that gasoline prices are likely to remain constant at $3.75/gallon over the next 5 years. You estimated that you will drive the car an average of 12,000 per year, and that you will sell it for 30% of its original value after 5 years.

a. Perform an incremental DCFA to determine which option is economically more attractive.

b. Repeat the calculation to determine if a $1,100 upfront income tax rebate from the Federal Government for the Hybrid version of the Honda Civic would change your conclusions (your income taxes will be reduced by $1,100 in the year of purchase).

c. What would a $0.1 per gallon annual escalation of fuel price do in scenarios (a) and (b)?