prepareRight, Inc. has engaged us to prepare its 2012 Federal (but not state) income tax return.

Your responsibilities are as follows:

1. Prepare prepareRight, Inc.’s 2012 Federal income tax return, Form 1120, including any supporting information and forms that you feel are necessary. All necessary tax forms (e.g., Form 1120) and the related instructions may be obtained via the IRS web site (www.irs.gov). Unless otherwise indicated in the attached information, you should reduce taxable income as much as possible.

2. prepare a letter to Russ Engle, the Treasurer of prepareRight, Inc., that includes instructions on how to file the return (where, when, etc.) and summarizing how much is owed as well as brief explanations of our treatment of any items that might surprise Mr. Engle (he knows GAAP quite well but doesn’t know much about tax rules and regulations…). Further, if estimated tax payments are necessary for 2013, instruct Mr. Engle on how and when to make them.

David Suroff is a graduate student in engineering at the University of Missouri at Columbia. David wrote so many papers as an undergraduate that he developed a new writing instrument to cut down on his preparer’s cramp. He found that his new pen, called Mr. prepare, worked beautifully for him. He showed it to his friends, who tried it out and really liked it. One even remarked, “I would pay a lot of money for a pen like this!” That comment got David thinking about developing the product and marketing it to the general public. He immediately got a patent on his design. However, he was not a businessman; at times he could barely handle balancing his checkbook! But all was not lost. David had a friend, Russ Engle, who was a graduate student in accounting and a CPA. Russ liked the product and volunteered to help David set up the company and run its business affairs. All they needed now was some startup capital. Russ had a friend, Josh Bonstead, an MBA student, who was independently wealthy and might be interested in investing in the idea. After trying out the product, Josh agreed to come aboard. Russ scheduled a meeting between the three of them to work out the details.

At the meeting, the group discussed the possible formation of a new venture and developed projections of profits and losses for the first five years of operations. The business was to be capitalized with $342,000 of cash and buildings worth $360,000 contributed by Josh. In return, he received 65% ownership of the new venture. David contributed the patent for the new product, with an agreed value of $270,000 (David has no basis in the patent) in return for a 25% interest in the venture. It was agreed that Russ would receive a 10% interest in the venture in return for his contribution of office furniture worth $108,000. Additionally, all three of them are to receive salaries based in part on sales and profits. Finally, Josh helped arrange a loan for $400,000 to be used for working capital and manufacturing equipment. The feeling was that they would be able to attract more investors after some of the start-up work had been completed.

Josh was excited about the new venture and about the drive and abilities of his new business associates. However, neither of them had any appreciable assets to speak of, and Josh was concerned about possible exposure to liabilities that might be created by the new venture. Based on his concerns, Josh persuaded David and Russ to organize the new venture as a corporation under Missouri state law and under Subchapter C of the Internal Revenue Code of 1986.

The company was incorporated and started doing business on January 2, 2011. prepareRight, Inc. is located at 4251 East Broadway, Columbia, Missouri 65201. The employer identification number is 25-4667912. The corporate officers are as follows:

Josh Bonstead President

David Suroff Vice-President

Russ Engle Secretary / Treasurer

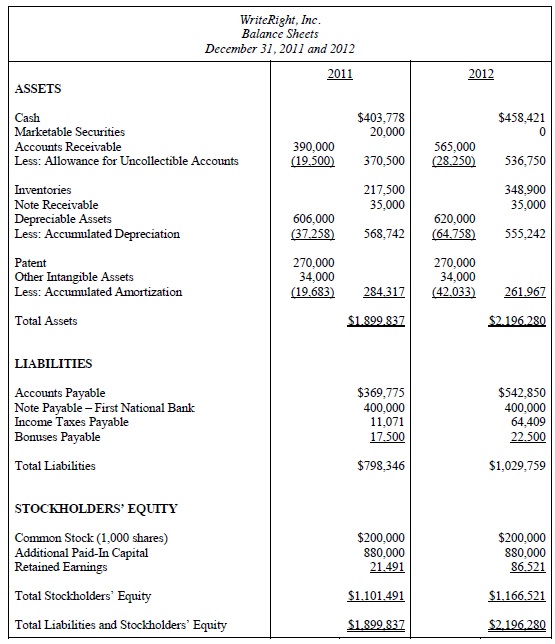

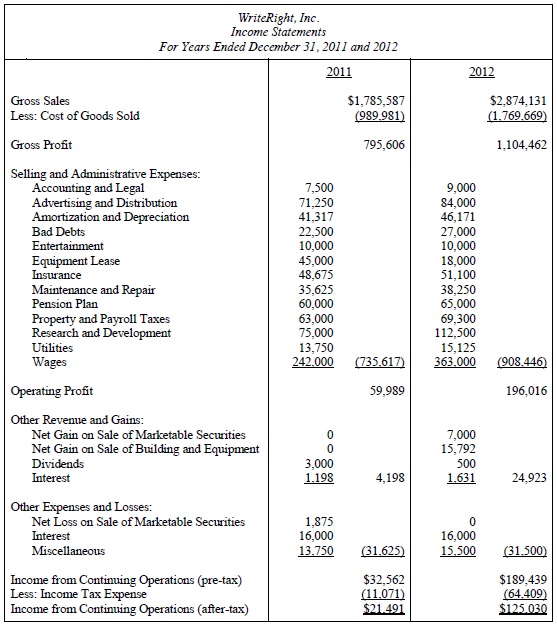

prepareRight, Inc.

Statements of Retained Earnings

December 31, 2011 and 2012

2011 2012

Beginning Balance, January 1st $0 $21,491

Add: Net Income (Loss) 21,491 125,030

Less: Cash Dividends Issued 0 (60,000)

Ending Balance, December 31st $21,491 $86,521

Additional information

1. On December 10, 2012, the company sold the remainder of its marketable securities for $27,000. The securities, originally purchased on February 6, 2011, are all from publiclytraded companies. The securities had a cost basis of $20,000.

2. On July 1, 2011, the company made an interest-free demand loan of $35,000 to David’s brother-in-law so he could pay off his student loans.

3. Prior to the opening of the business, Josh conducted a $10,000 marketing research tudy to test the demand for the new product. He was subsequently reimbursed by the corporation.

The corporation also incurred state incorporation fees and legal fees of $4,000. These costs are included in the Intangible Assets account. For GAAP purposes, Russ chose to amortize these costs over the maximum period allowed.

4. The note payable to First National Bank is a non-recourse note the proceeds of which were used to provide working capital to start the company. Interest accrues on the loan at a rate of 4% percent annually.

5. On December 26, 2011, the company declared and accrued bonuses payable in the amounts of $10,000, $5,000, and $2,500 to Russ, David, and Josh, respectively. Furthermore, on December 28, 2012, the company declared and accrued bonuses payable in the amounts of $10,000, $7,500, and $5,000 to Russ, David, and Josh, respectively. The bonuses were paid on January 15, 2013. The 2012 bonuses and their wages of $125,000 ($75,000 cash to Russ, $40,000 cash to David, and $10,000 cash to Josh) are included in Wages Expense. Russ, David, and Josh spend approximately 50%, 30%, and 10% of their time working for the corporation, respectively.

6. To reward purchasing agents for purchasing their product, the company has instituted a practice of awarding customers who purchase over $75,000 during the year four tickets to a St. Louis Rams football game. During 2012, 10 customers received tickets valued at $105 each (i.e., each customer received $420 worth of tickets). Russ views the gifts as enhancing customer relations; therefore he included the costs in Advertising and Distribution Expense.

7. Accounting and Legal Expense includes $3,500 incurred in lobbying for certain changes in the local zoning laws to allow the company to continue operating at its current location. They also include $1,250 incurred for Josh to travel to Washington, D.C. and testify at a Congressional hearing. A major piece of trade legislation was being examined and the company wanted to help ensure that no significant restrictions would be placed on the export of its products when it begins overseas sales in late 2014.

8. All employees, including Russ and David, receive employee fringe benefits of group term life insurance, accident and health insurance, and coverage under a qualified pension plan.

The 2012 expenses paid on behalf of Russ and David are as follows:

Russ David

Pension plan contribution $15,000 $4,500

Health insurance $4,000 $2,500

Group term life insurance $750 $500

The pension plan contributions are included in Pension Plan Expense and the health insurance and group term life insurance premium payments are included in Insurance Expense.

9. On December 31, 2012, the company declared and paid dividends of $60,000 payable as follows: $6,000 to Russ, $15,000 to David, and $39,000 to Josh.

10. Josh’s younger brother, Michael, who is 17 years old, came to work at prepareRight, Inc. during the summer of 2012 while he was out of school on summer vacation. His duties consisted of clerical services, running errands, and straightening up around the office. His total salary for the summer was $15,000 and is included in Wages Expense.

11. Entertainment Expense includes a $4,000 annual membership to Columbia Country Club. The company uses the club to entertain potential customers who may visit their facility. Another $3,500 was spent on meals and greens fees while entertaining at the club. Finally, $1,500 was spent on meals, drinks, etc. entertaining clients at other locations.

12. Miscellaneous Expense includes $750 in payroll tax penalties incurred before Russ figured out exactly how and when those taxes were to be paid. It also includes a $1,000 contribution to the Republican National Committee made on April 15, 2012.

13. prepareRight, Inc. has a calendar year-end and uses the accrual method of accounting for tax purposes.

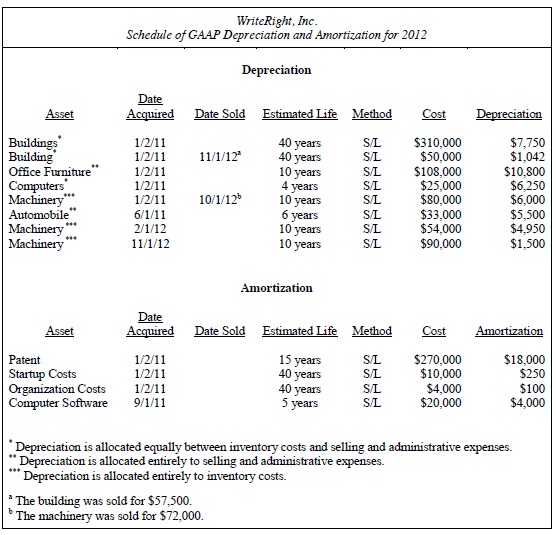

14. prepareRight, Inc. uses the cost method of valuing inventory. In 2012, $1,576,098 worth of goods were purchased. In addition, $305,000 of wages and a portion of the depreciation expense were allocated to inventory costs under GAAP (and are allocable to inventory costs for tax purposes under §263A). Assume that the $348,900 GAAP valuation of ending inventory is proper for tax purposes.

15. prepareRight, Inc. paid $50,000 in estimated income taxes to the Internal Revenue Service in 2012 towards their 2012 estimated tax liability. If owed, the company prefers that the IRS find out tax penalties and interest.

16. The allowance method is used for determining uncollectible accounts with the allowance account based on a percentage of accounts receivable at the end of the year.

17. The corporation did not take any §179 expense on its depreciable assets for 2011 and for 2012 it affirmatively elected not to take additional first-year depreciation on any of its depreciable assets. It wants to continue those policies for 2011.

18. The computer software was developed by prepareright to improve the efficiency of its manufacturing process.

19. The corporation is not a grantor to a foreign trust, nor does the corporation maintain a foreign bank account or foreign security account.

20. The corporation has no subsidiaries nor does it control, directly or indirectly, another organization.

21. All of the owners are United States citizens. Relevant information about each owner is as follows:

Name Residence Social Security Number

David Suroff 2312 Parks Edge PlaceColumbia, MO 65202 913-46-3981

Russ Engle 50F Broadway Village DriveColumbia, MO 65201 452-72-9034

Josh Bonstead 234 Katy Lane Columbia, MO 65203 314-57-3618

Guidelines

1. Use the Adobe Acrobat fill-in forms available at the IRS web site to do the return.

2. Round all amounts on the return to the nearest penny. However, do not round intermediatecalculations.

3. Check the return for mathematical accuracy.

4. Be sure the name and identification number of the taxpayer is on EVERY page of the return (even if the front and back of a form are on different pages). If the return were to come apart, this would be necessary to reorganize it. Also make sure ALL information asked for on the return is provided (However, it is usually unnecessary to enter “0” on lines for which the taxpayer has no income, deductions, assets, etc.).