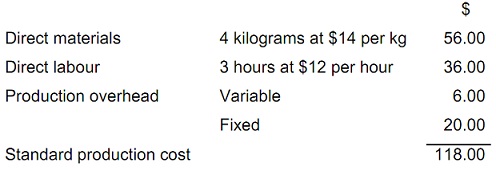

PNQ Limited manufactures and sells a single product. The standard production cost for a single unit of the product is as shown below:

In order to find out the fixed production overhead rate per unit, a normal operating capacity output level of 32,000 units per annum is supposed.

The selling price of the product is $280 per unit.

In addition to production overheads, the company as well incurs selling, distribution and administration overheads. These are as shown below:

Variable overheads: 20 % of the sales value

Fixed overheads: $360,000 per annum

In the relevant period, the only variance to take place is a fixed production overhead volume variance.

On 1 April 2010, there were no units of finished product in stock. The fixed overhead expenses are incurred at an even rate all through the year.

The sales team of PNQ Limited has made a summary of the number of units produced and sold for the year. This is as shown below:

1/4/2010 - 30/9/2010 1/10/2010 – 31/3/2011

Production 17,000 14,000

Sales 14,000 16,000

Required:

a) Make statements for management which show sales, costs and profits for each of the six monthly periods, by using:

• Marginal costing

• Absorption costing

b) Make and describe a statement that reconciles the profit for each period by using marginal costing, to that when absorption costing is used.

c) Identify and describe three situations where the use of marginal costing might prove more helpful than absorption costing to the managers of PNQ Limited.

d) Outline two benefits and two drawbacks of absorption costing.