PEACHTREE PROPERTIES

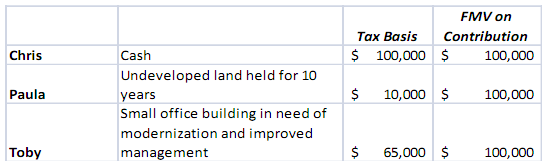

Chris, Paula, and Toby agreed to join forces to operate a real estate venture to be known as Peachtree Properties. The entity was created on July 1, 2012. Two principal activities are contemplated for the entity: (1) investing in raw land to hold for appreciation; and (2) buying poorly maintained, but well-located office buildings that Peachtree will refurbish and manage/rent until there is adequate cash flow for enough years to support a target market price of double the initial investment. The owners contributed the following assets.

All three owners work in the business 8-12 hours per week. Each also has another job. Chris, Paula, and Toby have decided that they should form an LLC to protect themselves from liabilities created by the business while getting pass-through treatment for income tax purposes.

Advise Chris, Paula, and Toby about the wisdom of their forming an LLC for this enterprise, as opposed to say an 5 corporation or limited partnership. Regardless of your view about whether an LLC is appropriate for Peachtree and its owners, discuss the steps necessary to become an LLC from a legal standpoint, while treated as a partnership for tax purposes. Peachtree will use a calendar tax year.

For Parts II assume Peachtree is organized as an LLC. Analyze the series of transactions described in Parts II and advise the Peachtree members as to the tax consequences of each transaction if they are respected as independent transactions. Cite relevant authorities. Apply 2012 federal income tax law.

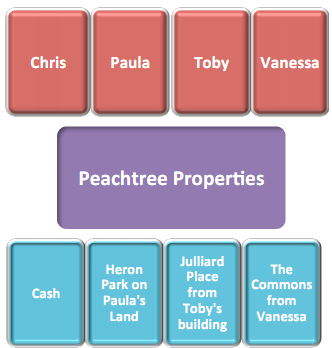

At the beginning of 2013, Chris identifies a rental property (The Commons) he thinks can be profitably developed. The property is worth $150,000. Vanessa, the owner of The Commons, is interested in selling and holds a $225,000 basis in the property. The members believe that although most of Peachtree's properties will be held only two to three years, Peachtree will need about ten years to realize the profit potential of The Commons.

At the time of the negotiations regarding The Commons, Peachtree holds very little cash. It is building on the land contributed by Paula (Heron Park). Peachtree sold the renovated office building contributed by Toby six months before and reinvested in another small office building (Juilliard Place). Juilliard Place is generating a moderate cash flow, after some upgrades made by Peachtree. Peachtree's assets at this point are worth $450,000.

After some discussion, Vanessa and Peachtree came to the following agreement. Vanessa will transfer The Commons to Peachtree in exchange for a 25% interest in the LLC, with the understanding that she is not interested in remaining a long-term member of the LLC. All members will share equally in the cash flow of Peachtree. When the next property is sold, unless Vanessa decides that she wishes to retain a longer term interest in Peachtree, an amount approximately equal to the value of Vanessa's interest will be invested in an investment asset that is not a §731(c) marketable security. Within two years of this investment of the sales proceeds in another asset, Vanessa will withdraw from the LLC by taking a distribution of the investment asset in exchange for her interest. No §754 election will be made.

Peachtree sells Heron Park in 2015 for $250,000. Peachtree then buys undeveloped land for $200,000 and uses the remaining proceeds to further improve Juilliard Place.

At the beginning of 2016, Vanessa identifies a potential purchaser for the undeveloped land. She requests that the land be distributed to her in exchange for her LLC interest. The fair market value of all Peachtree assets is $800,000 at the time of Vanessa's withdrawal. The basis

and fair market value of the land that Vanessa takes in exchange for her interest is $200,000. At that time, Vanessa's basis in her interest in Peachtree is $275,000. Shortly after receiving the distribution of the undeveloped land, Vanessa sells it for $200,000.

Required:

You will be meeting with Chris, Paula and Toby about these issues. Write a memo to the file of Peachtree addressing the issues raised in Part I and II including your analysis.