James and Ann Wilson, two Australian citizens, have been living in Sydney since 1 February 2006. James has been meticulous in keeping records and provides you with the information below. It should be noted that this information represents his understanding of what was relevant for tax purposes, and you will need to form your judgement on the various matters based on your knowledge of Australian income tax law. If any doubt arises on a particular issue or further information would normally be required, you may assume such details as are necessary to complete the tax return. All such assumptions and the basis of any decisions you make in various matters, must be made clear by appropriate reference to legislation, cases or tax rulings and full discussion where necessary.

Information regarding the 2012/2013 Income tax year

Business:

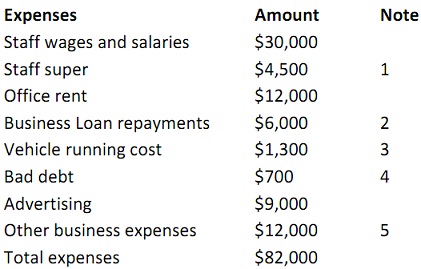

The data related to James’ computer consulting business (commenced in Sydney on 1/3/2013) for the period 1/3/2013 to 30/6/2013 is as follows:

Income:

Consulting fees $120,000

Computer parts $45,000

Total income $165,000

The above figures correspond to income earned and credited to accounts. All income relating to the sale of computer parts was collected on 30 June 2011. However included in consulting fee income is an amount of $15,000 invoiced on 29 June 2011 but payment was only received on 6 July 2011. In addition to the above, James has also received a prepayment of consulting fees in the amount of $8,000 for work he will undertake in August 2011. This amount is refundable if James cannot undertake the work.

1) Staff super contributions were paid to the superannuation fund on 10 July 2013

2) Loan repayments include a business loan principal payback of $4,000 and interest of $2,000

3) These running costs relate to the vehicle purchased with the business. The vehicle is not available for private use.

4) The bad debt amount corresponds to a letting fee and property management fees which could not be recovered from the owners. The amount has been written off as a bad debt in the books before 30 June.

5) Includes $500 for a traffic fine incurred by a staff member but reimbursed by the business Personal Income.

Foreign source income:

James holds a term deposit in Japan, with $2,000 interest paid in the financial year.

Australian source income:

Employment income while in Sydney: Gross pay: $42,000; PAYG amounts deducted: $5,500

Personal deductions:

James also incurred the following expenses, which he thinks may be claimed as tax deductions

Computer Society of Australia membership fees: $750

Travel expenses to Sydney to attend a conference on development potentials in the Central NSW region: $400 + Conference entrance fee: $350

Membership to the Newcastle Golf Club: $600; James considers that membership is vital to make business contacts.

Required:

On the basis of the information that James has provided you and assuming that there are no other circumstances affecting his tax liability, determine James’ taxable income for the 2012/13 income tax year.

In your answer you must provide references to the relevant sections of the ITAA 1936 and ITAA 1997, case law, Tax Rulings or Tax Determinations. You should ignore the possible incidence of GST while answering the above requirements.

Formatting Requirements:

The assignment should be presented as follows:

• Font/Font size: Times New Roman (preferred) /12, regular;

• Margin: 2.54 cm (Left, right, top and bottom);

• Page numbers: yes;

• Line Spacing: 1.15;

• Paragraph Style: Justified.