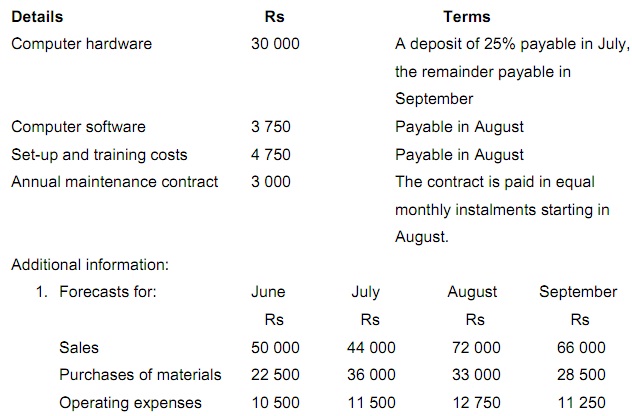

Angel Build Ltd. supplies building materials. The directors are proposing to buy a computer system which will give electronic recordings of sales and stock. The directors have obtained the given estimated prices for the computer system.

2) Sales are made on the basis of 60% cash and 40% credit. Credit customers are expected to pay one month after the sale.

3) Purchases of materials will be paid one month after the purchase.

4) Operating expenditures will be paid in the month they are incurred.

5) Depreciation of fixed assets is estimated to be Rs 1250 per month.

6) The directors intend to pay an interim dividend of Rs 27 550 in August.

7) The directors encompass negotiated an overdraft facility of Rs 20000.

8) The bank balance at 30 June is estimated to be Rs 400 overdrawn.

Required: Make a cash budget for each of the three months, July, August and September, supposing the directors purchase the computer system.