Instructions for Candidates:

1. Answer all of the question below;

2. Each question is worth ten (10) marks;

3. Please type your assignment;

4. All diagrams and direct quotations must be referenced, as per the course description specific method.

Question 1:

a) You are examining and reporting on the market performance of very small number of firms that are known to often collude in setting output prices and quantities. Illustrate and explain using a diagram, what affect this behavior is most likely to have on the allocation of factors of production;

b) What will happen if one of these firms cheats on the others in some way? Illustrate and explain using a diagram;

Question 2:

a) Assuming a constant wage rate, illustrate and explain using a diagram, how a firm's marginal costs of production are at a minimum when its marginal product is at a maximum;

b) Illustrate and explain using a diagram how a firm's long-run average cost curve comes into existence from a multi-plant operation;

c) Identify and describe the significance of the various position of this diagram.

Question 3:

a) Illustrate and explain using diagrams: two (2) of the market mechanisms that are used for controlling pollution as an externality:

Question 4:

a) Illustrate and explain using diagrams, the difference between long run supply in a constant cost individual firm and industry and an increasing cost firm and industry;

Question 5:

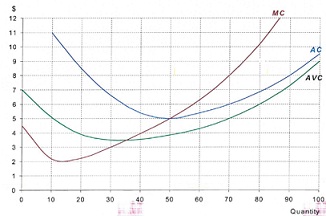

The following diagram shows the cost curves of a firm under perfect competition.

a) How much will the firm produce in order to maximize profit at a price of $8 per unit?

b) What will be its average cost of production at this output?

c) How much (supernormal) profit will it make?

d) How much will the firm produce in order to maximize profit at a price of $5 per unit?

e) How much (supernormal) profit will it make?

f) How much will the firm produce in order to maximize profit at a price of $4 per unit?

g) What will be its profit value be now?

h) Below what price would the firm shut in the short run?

i) Below what price would the firm shut in the long run?

APA reference styling