Include assumptions about the elasticity of the demand and market structure for the company’s good or service. Analyze data to determine fixed and variable costs.

Answer the following problems with justification:

i) How will you increase revenue?

ii) How will you determine the profit-maximizing quantity?

iii) How could you use the concepts of marginal cost and marginal revenue to maximize profit? What information do you need to determine this? Without this information, how would you make a decision?

iv) Are there other ways to minimize costs for the product?

Thomas Money Service Inc. Scenario

Thomas Money Service Inc. has been in business since 1940. It started out as the consumer finance company granting small loans for the household needs. Over the following 5 years, company expanded its services by issuing business loans, business acquisition financing, and commercial real estate loans.

In 1946, decision was made to branch out into equipment financing. Subsidiary named Future Growth Inc. (FGI) was established. This decision turned out to be very profitable. Because of the end of World War II, society had huge demand for the construction and forestry equipment. Because of increasing demand for this type of equipment, FGI decided to make very daring move in 1951 and purchased the equipment manufacturing company. Now they can build, sell, and finance their own brand of building and forestry equipment. FGI discontinued financing other brands of equipment.

For 67 years, FGI had been able to truthfully state that they have continuously increased profits year after year, even during economic downturns, and have never laid off workers. This track record has allowed their stock to grow from $5.00 to $85.60 with six stock splits from 1975 to 1998. FGI has never issued bonds, and the present stock value is $35

Current global downturn has caused the American economy to suffer. Oregon, Washington, and several other forestry states have encountered flooding, massive fires, and protest from animal activists. For the first time in the FGI history, profits declined—down 30% from last year—and they had to lay off one-third of their workforce.

Falling economy has also caused a drop in new-home sales: sales dropped 30% from the previous year and additional declines are expected. This has caused a domino effect throughout the entire construction industry. Not all sectors, however, are being hit equally by the economy. Opportunities are in hospitals and nursing homes that have a demand for new buildings.

Data

• There are currently many domestic and international companies manufacturing construction and forestry equipment. Each company’s equipment offers slightly different features and functions that allow market to supply many substitutes.

• FGI has repossessed over 500 pieces of equipment during the past year. They have bundled the pieces together and determined an average price for each piece. Present selling price is $1,732. Below are the demand figures for each price.

Demand data in millions in the past years

Price Demand

1,990.1 123

1,732.0 182

1,634.3 350

1,252.0 380

732.1 400

622.3 456

• In recent years, FGI had decreased its advertisement revenue, selecting to have the commercial during the Super Bowl and a few other sporting events.

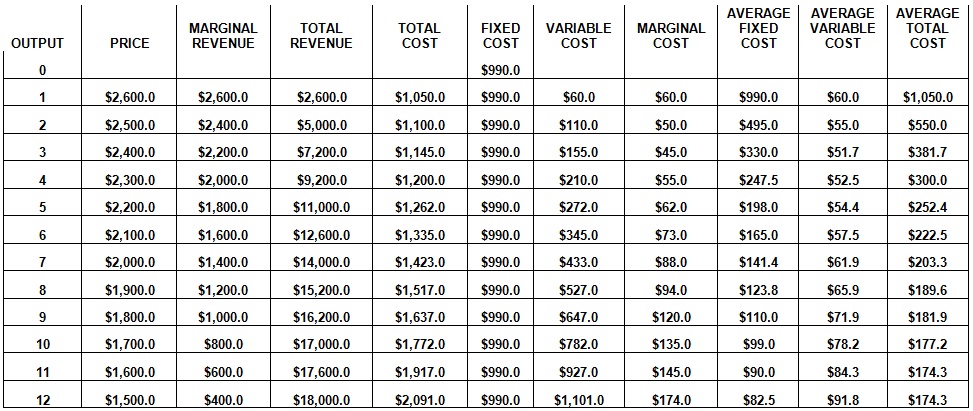

FGI has cut down on manufacturing because of the lack of demand. Below is the combined production cost for construction and forestry equipment. What level of demand generates the greatest net income?