Wise Start Ltd, a newly formed company is to start trading from 1 January next. You have been asked to help with their financial predictions.

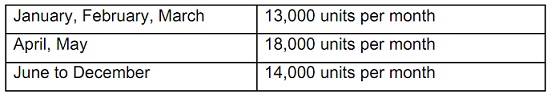

1) They plan to sell their product at an initial selling price of Rs 60 each; however as an incentive, the selling price will be decreased to Rs 50 for the month of April and May only. The sales budget in units is:

All the sales will be on credit and it is expected that half of debtors will take one month’s credit and the remainder will take two months.

2) Purchase price will be Rs 40 per unit. Though, when monthly purchases exceed 15,000 units, a special quantity discount of 5 % will be given by the supplier.

3) The stock will be maintained on the first in first out (FIFO) system at a constant level of 6000 units, and the initial stock will be purchased on 1 January. The suppliers of the product have agreed to give one and a half month’s credit terms, that is, all stock purchased in January will be paid in the middle of March.

4) Delivery, post and parking will cost Rs 3 per unit sold and will be paid as incurred. Other costs will be constant at Rs 85,000 per months and Wise Start Ltd will be given one month’s credit.

5) Rent will cost Rs 240,000 per annum and is payable quarterly in advance. Equipment costing Rs 1,800,000 will be purchased and paid for on 1st January and is to be depreciated at the rate of 15 % per annum based on cost.

6) As the company doesn’t have an established track record it is not able to borrow money. The shareholders agree to put in just adequate capital to make sure that the minimum balance on the bank never falls below Rs 1,000. They as well agree that a dividend equivalent to 10 % of the subscribed share capital be declared out of the first six months’ of trading result and be paid to them on 1 September next.

Required:

a) Make a cash budget for the first six months of trading from January to June inclusive.

b) In brief describe some advantages of cash budget, making reference to an organization of your preference.