problem 1: How is residence of assesses determined? Describe tax liability on the basis of residence.

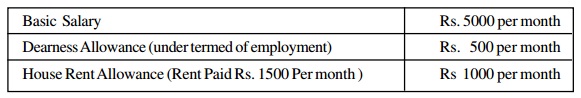

problem 2: Shri A.K Rana is an employee in a company in Mumbai. He received in prior year:

He retired on 1st January, 2011 after 20 years of service. He was paid Rs. 6000 gratuity and Rs. 50,000 of unrecognized provident fund. He was given pension of Rs. 800 per months.

He was not covered under Payment of Gratuity Act. Employer and employee’s contribution is equivalent.

Salary and pension become payable on the last day of each month. For the assessment year 2011-12, find out Mr. A.K. Rana’s taxable salary.

problem 3: What do you understand by annual value? Describe the deductions allowed from annual value?

problem 4: find out Income from other sources of Dr. Ashish Agrawal for the assessment year 2011-12 from the given particulars of previous year 2010-11.

a) Found Rs. 10,000 lying on road

b) Income From card games Rs. 2000

c) Income from Royalty Rs. 6000

d) Remuneration received Rs. 4000 for being an examiner.

e) Remuneration received Rs. 1000 for articles written for magazines.

f) Income from agricultural law in Kathmandu (Nepal) Rs. 11000

g) Income from fisheries Rs. 3000

h) Amount rent of law received Rs. 4000

i) Interest received on bank deposit Rs. 15004

j) Dividend received Rs. 3000 on shares of Indian company

k) Winnings from lottery Rs. 2000

l) Winnings from horse race Rs. 1500 (20)

problem 5: prepare short notes on the terms below:

a) Exempted Incomes.

b) Perquisites.

c) Exempted Capital Games.

d) Deduction of interest on loan taken for higher education (80E)