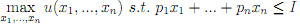

1. General Utility Maximization

List the Örst order conditions for the following problem:

First ignore the implicit constraints: 8 i; xi � 0 and give the FOCs. Then take them into account and give the Kuhn-Tucker Conditions. Simplify your expressions as far as you can.