1.The accountants hired by Davis Golf Course have determined total fixed cost to be $75,000, total variablecost to be $130,000, and total revenue to be $145,000. Because of this information, in the short run, DavisGolf Course should

a. decide to shut-down.

b. decide to exit the industry.

c. decide to stay open because shutting down would be more expensive.

d. decide to stay open because they are making an economic profit.

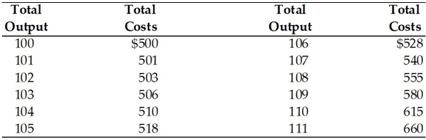

2) Refer to the above table. This firm operates in a perfectly competitive market in which the market price is $10 per unit. What is its profit-maximizing rate of production?

A) 108 units

B) 104 units

C) 110 units

D) 106 units

3) Refer to the above table. This firm operates in a perfectly competitive market in which the market price is $10/unit. What is true when the firm produces 103 units?

A) Total costs exceed total revenue by $403.

B) Marginal revenue is less than marginal cost.

C) Total revenue equals $5,060.

D) Its total profit is $524.

4) If price is $5, marginal cost is $5, average total cost is $3, and the quantity produced is 150 units, then the firm is

A) not maximizing economic profit.

B) earning $300 and maximizing economic profit.

C) earning $150 and not maximizing economic profit.

D) earning $2 and maximizing economic profit.

5. Assume the price of a product sold by competitive firm is $5 .Given the data in the accompanying table , at what output is total profit highest in the short run ?

|

Output

|

Total Cost

|

|

20

|

70

|

|

25

|

75

|

|

30

|

85

|

|

35

|

100

|

|

40

|

125

|

|

45

|

155

|

|

50

|

190

|

A.20

B.30

C.40

D.50

6. Answer the Question based on the table below

|

Price

|

Quantity

|

TFC

|

TVC

|

|

5

|

5

|

25

|

10

|

|

5

|

10

|

25

|

20

|

|

5

|

15

|

25

|

50

|

|

5

|

20

|

25

|

60

|

At what point on the table would a purely competitive firm cover all of its costs and earn only normal profits?

A.Q=5

B.Q=10

C.Q=15

D.Q=20

|

output

|

Price

|

Total cost

|

|

0

|

500

|

250

|

|

1

|

300

|

260

|

|

2

|

250

|

290

|

|

3

|

200

|

350

|

|

4

|

150

|

500

|

|

5

|

100

|

680

|

7. Refer to the above information, if Monopolist could sell each unit of the product at the maximum price the buyer of that unit would be willing to pay for it , and if the monopolist sold 4 units, total revenue would be :

A.$900

B.$1000

C.$1400

D.$1900