problem 1: Define the concept of opportunity cost in your own words. Given an ex from your own life of the opportunity cost of a decision. describe why opportunity costs rather than “out of pocket” costs are the appropriate cost measure for social benefit cost analysis.

problem 2: A foreign company plans to clear several dozen acres of ecologically valuable mangrove swamp in Vietnam for the creation of a shrimp aquaculture facility. This decision will create economic profits of $5000/year to the company (which hires substantial numbers of local villagers) after one year of construction but will cost $10,000 (paid upfront) to build. In addition, the loss of the mangrove habitat will reduce spawning and nursery habitat for valuable fish species – thus reducing the catch of fish by artisanal fishermen from 1000 tons to 750 tons per year (which has a market value, after costs, of $10/ton). Assume that these losses are experienced from the very first (construction) year onward and are permanent.

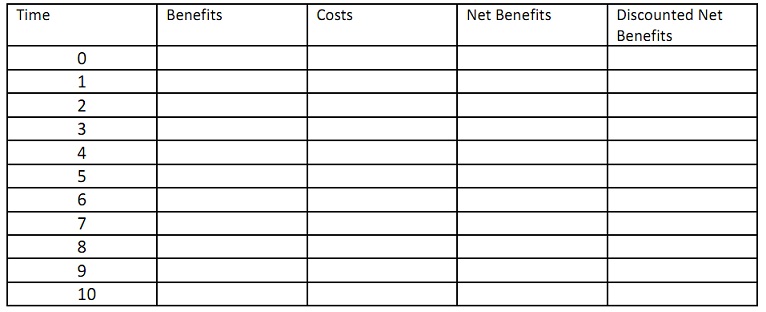

a) Assume that the discount rate is 5% (r=.05) and the evaluation horizon is 10 years from the present. Please neatly fill the blanks in the table below.

b) What is the net present value of this proposed project? If efficiency was the only objective for making the decision and we have fully accounted for all costs and benefits would you recommend the project go ahead or not?

c) Would the demonstration of a $.50 per family average willingness to pay for the preservation of the mangrove habitat on the part of middle to upper-class families in developed countries change your perception of the efficiency of this project? (Yes/no and why?).

problem 3: The government of a small South Pacific island is considering whether to allow development of a small but valuable deposit of phosphate rock. Not having the resources to develop and mine the deposit themselves, the country has the option to sell a lease to a foreign mining company for an immediate one-time fee of $12 million – resources that can be used to address many development challenges in the country. The lease will expire (and the deposit will likely be mined out) in 20 years. A panel of experts suggests that the mining of the phosphate, despite the use of best practices to avoid contamination, will eventually result in contamination of surface and groundwater supplies in a manner that will increase health risks for some residents. Best estimates of these health-related damages (willingness to pay to avoid the damage) are a total of $18 million. Moreover, the health effects are not likely to be experienced until the end of the 20 year lease.

a) Suppose that the government of the island choose a discount rate of .04. What is the present value of the damages created by the project? What is the net present value of the project from the vantage of the government? Assuming this is the best (i.e. most efficient) way to develop the phosphate resource, is doing so justifiable on the basis of economic efficiency?

b) Find the breakeven discount rate such that the net present value of this development opportunity is zero (i.e. find the internal rate of return).

c) The government of the country has decided to allow the project to go forward. However, as a measure to deal with perceived inequities across generations, they decide to invest a substantial portion of the lease payment. Assume that $9 million is invested at a 4% annual rate (compounded annually). Will the future value of this investment be sufficient to compensate those that suffer damages in year 20?

d) Read p. 96-100 of Goodstein. How does the “environmental bond” discussed in c) help to foster sustainability in the “neoclassical” sense discussed by economists like Robert Solow?2

problem 4: You perform a travel cost study that looks at the relationship between the cost of visiting a lake (including costs of travel, value of time spent not working & any entry fees), its water quality (measured by the concentration of fecal coliform bacteria) and the actual numbers of visitors. Circle the categories of values (willingness-to-pay) that this method can potentially uncover for individuals (there may be more than one).

a) Changes in recreational use value related to planned improvements in water quality.

b) Reductions in consumer welfare from increasing the entrance fee.

c) Benefits to homeowners that never use the lake but enjoy views of the lake and have increased property values due to their proximity to the lake.

d) Changes in the non-use value of the lake as its perceived quality changes.

problem 5: The total demand (marginal benefit) curve for visiting Yosemite is as follows: Price = 5000-10*NumberOfTrips -10*TonsOfVisibleTrash.

a) Suppose the quantity of trash=100 tons. Draw the demand curve below, being sure to label the axes and the slope and intercept appropriately.

b) Does the quantity of trash increase or decrease the willingness to pay for an additional trip?

c) Suppose the park charges an entrance fee of $100. What is the total net benefit to consumers who visit the park (the “consumer surplus”) if this is the only travel costs (all other costs of the trip are zero)? In answering this problem, continue to assume that the quantity of trash remains 100 tons.

d) Now assume the park implements a cleanup program to reduce the trash in the park to 20 tons. Assuming the entrance fee from c) remains the same, what is the new consumer surplus? What was the economic benefit to park visitors from the cleanup program?