Data file contains 1500 houses sold in Stockton, California, during 1996-1998. The variable descriptions are as follows:

• Sprice = Selling price of home, dollars

• Livarea = living area, hundreds of square feet

• Age = age of home at time of sale, years

• Baths = number of bathrooms

• Beds = number of bedrooms

• Pool = 1 if home has pool, 0 otherwise

• Lgelot =1 if lot size > 0.5 acres, 0 otherwise.

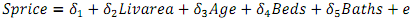

Model 1:

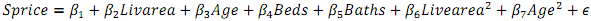

Model 2:

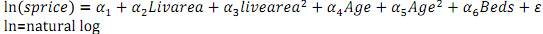

Model 3:

Q1.

Plot each of Sprice and Age in a X-Y scatter plot and comment on their pattern.

(To obtain XY scatter plot in Gretl select "View" and "Graph specified vars" and "X-Y scatter" and choose the variables to the relevant boxes)

Q2.

Estimate Model 1 and report the results. Do the signs of the estimates agree with your expectations? Explain.

Q3.

Using Model1, test the null hypothesis that each individual coefficient is equal to zero against the alternative that it is not, at the 5% significance level and comment on your findings

Q4

Consider two houses that have the living areas of the same size, the same number of bathrooms, and the same number of bedrooms, but one is two years old and the other is ten years old. How much difference in the prices should an investor expect between the two houses according to Model 1? Construct a 95% confidence interval for this difference in the prices and interpret your result (4 marks)

Q5.

Test the overall significance of the model at the 1% significance level. Interpret the test result.

Q6.

A family of four children owns a house with a living area of 2,000 square feet (i.e. Livarea = 20). They are now considering an extension of the living area by 200 square feet. How much would this extension be expected to increase the price of the house? Test a hypothesis, at the 5% significance level, that the increase in the price will be equal to $20,000 against it is more than $20,000. (4 marks)

Q7.

Estimate Model 2 and use an F- test to test that Livearea2 and Age2 are important variables in the model? Use the 5% significance level and comment on your results.

Model 3

Q8.

Estimate Model 3 and comment on your results.

Q9.

Use Model 3 to predict the price of a 10-year-old house with a living area of 2,000 square feet, and three bedrooms. Comment on your answer

Models 2 and 3

Q10.

Compare the results of Model 2 and Model 3 and choose a preferred model. Give reasons for your choice.

Download:- DATA.gdt