Jarvis Ltd. uses an absorption costing system. Its product goes via a machining department and an assembly department. Such departments are supported by three service departments namely Service Department 1 (S1), Service Department 2 (S2) and Service Department 3 (S3).

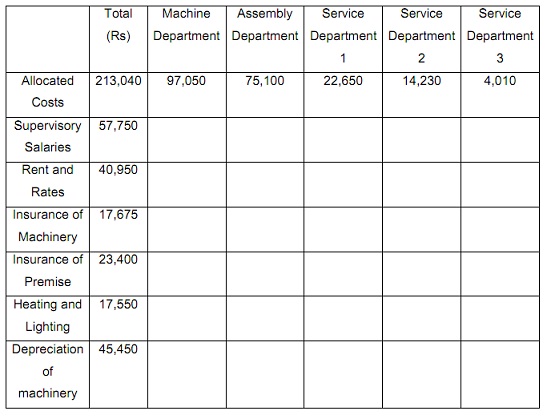

Mr. Carl, the management accountant of Jarvis Ltd. has given the following budgeted overheads costs for the coming year.

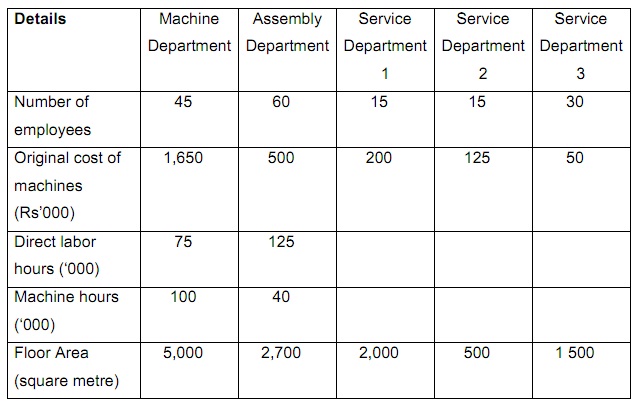

The other budgeted information is as illustrated below:

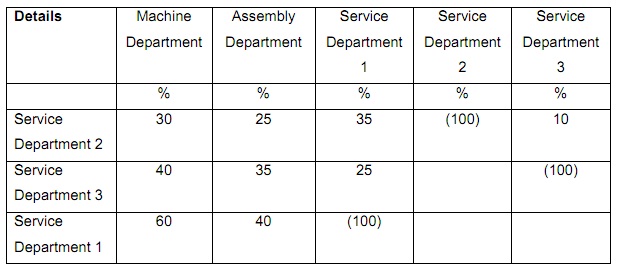

Jarvis Ltd. has the policy of apportioning the cost of service departments as shown:

Required:

a) Make a statement to show the total overheads for each production department, exhibiting the basis of apportionment chosen.

b) Compute an overhead absorption rate for each production department, by using the most appropriate basis of absorption.

c) Computed Overhead Absorption Rate (OAR) is Rs11. The actual overheads for Assembly Department were Rs 142,360 and actual direct labor hours worked was 12,515. Compute the amount of over or under absorbed overheads.

d) Describe four differences between the financial and management accounting.

e) Describe the benefits of Activity Based Costing (ABC).

f) What are the barriers to implementing the ABC in an organization?